2025 Predictions for U.S. P&C Insurance Show Uncertain Futures

Beinsure Media

Beinsure Media

P&C underlying economic growth ended 2024 slightly below U.S. GDP growth at 2.3% versus 2.5% year-over-year (YOY). However, in 2025 and 2026, P/C underlying growth is expected to be above overall GDP growth, an improvement in year-end expectations.

A further economic milestone occurred in 2024 with the number of people employed in the U.S. insurance industry surpassing three million.

Beinsure analyzed the Triple-I’s report and highlighted the key points.

Insurance Segment Highlights

P&C underlying economic growth is expected to remain above overall GDP growth in 2025 (2.3% versus 2.1%) and 2026 (2.6% versus 2%) as lower interest rates continue to revive real estate and contribute to higher volume for homeowners’ insurance and commercial property.

This is an improvement on our 2025 P&C underlying growth expectations from second half of 2024. The pace of increase in P&C replacement costs is expected to overtake overall inflation in 2025 (3.3% versus 2.5%).

This aligns with our earlier expectations from the second half of last year.

According to Global Insurance Market Index, commercial insurance rates declined by 3% in Q1 2025, the third consecutive decrease in the composite rate following seven years of increases. A continuing increase in insurer competition was the main catalyst behind rate trends, which declined globally in every region and across all major product lines other than casualty.

Marsh’s analysis shows global property insurance rates fell 3% in Q4, with the Pacific region experiencing the sharpest decline at 8%.

The U.S. and UK saw 4% reductions, while Canada, Latin America, the Caribbean, and Asia reported slight decreases.

Financial and professional lines rates fell 6% globally, with declines in every region. Cyber insurance also dropped 7%.

Personal Auto Insurance

The net combined ratio (NCR) for personal auto in 2025 is projected at 96.0, about 1 point higher than in 2024, yet still reflecting ongoing profitability.

Homeowners Insurance

Wildfires in Los Angeles in January 2025 drove significant losses, resulting in the worst first-quarter loss ratio for homeowners in over 15 years and the worst quarterly result since Q2 2011.

General Liability Insurance

The Q1 2025 general liability loss ratio was the second-worst first quarter in more than 15 years, improving by less than 1 point compared to Q1 2024 and signaling continued profitability concerns.

Insurance Industry Trends and Economic Factors

Insurance Premium Growth

Net written premium growth for 2025 is forecast at 6.8%, down 2.0 points from 2024 and the lowest since 2020. Personal lines are expected to outpace commercial lines by 1.5 points in 2025, though the gap is projected to narrow by 2027.

Further premium growth and improved underwriting performance should continue in 2025 and 2026, provided geopolitical and economic conditions remain relatively stable.

Property catastrophe rates remain high due to the growing frequency and severity of storms. Larger insurers can better manage these risks through diversified portfolios and strong reinsurance protections.

However, in states like Florida, smaller specialty insurers depend heavily on reinsurance and state-backed programs such as the Florida Hurricane Catastrophe Fund and Citizens Insurance. If losses exceed reinsurance coverage, many of these firms could face financial distress.

Hurricane intensity is becoming more unpredictable due to rising sea surface temperatures. Recent storms, including Helene and Debbie, have impacted areas previously considered lower-risk.

Profitability

The industry-wide NCR is projected at 99.3 for 2025, 2.7 points higher than 2024. Broader profitability is anticipated to return in 2026 despite current challenges in specific lines.

Michel Léonard, Ph.D., CBE, chief economist and data scientist at Triple-I, remarked that the U.S. economy and P/C industry have shown resilience despite tariffs and trade uncertainty, with industry growth outperforming U.S. GDP.

However, he warned that revised economic data later this year may indicate a weaker economy and raise concerns about contraction or recession heading into fall.

With inventories running low, their depletion will now accelerate inflation and slow growth for the rest of the year.

Michel Léonard, Ph.D., CBE, chief economist and data scientist at Triple-I

He noted that rising prices, especially for personal auto, are significant, with used car and truck prices up 7.7% in the first half of 2025.

The P&C industry typically lags the economy by one to two quarters, suggesting potential industry impacts from broader economic contraction beginning in Q1 or Q2 of 2026.

US Insurance Market Rates

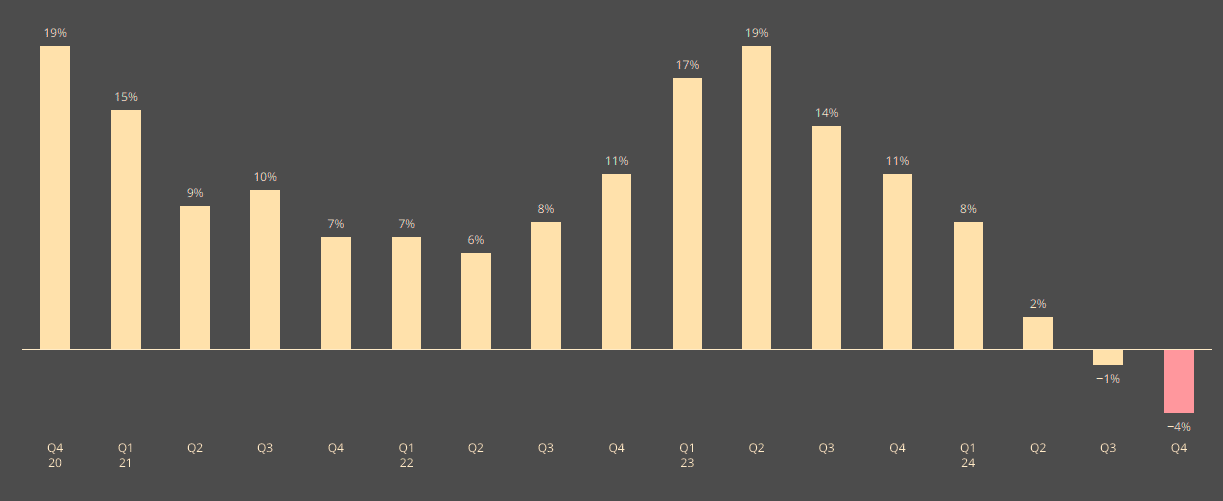

Below are insights into the US insurance market rates. U.S. property insurance rates dropped 4%, a sharper decline than the 1% recorded in the previous quarter.

Increased insurer capacity, driven by strong financial results over the past three years, contributed to the trend. Casualty insurance rates rose 7%, with an 11% increase when excluding workers’ compensation.

US property insurance rate change

Property insurance rates declined 4%, compared to a decline of 1% in the prior quarter. Casualty insurance rates increased 7%; excluding workers’ compensation, the increase was 11%.

The property market remains sensitive to loss events, particularly the ongoing Los Angeles wildfires, which will impact aggregate catastrophe losses in 2025.

Workers’ compensation continued to be the primary casualty line of interest for most insurers; however, concerns continued regarding increasing reserves and rising medical costs.

Auto liability continued to pose profitability challenges for insurers due to larger jury verdicts nationwide and rising auto physical damage costs. General liability rates remained relatively stable, with average increases of approximately 3%.

In the umbrella and excess liability market, risk-adjusted rates increased 15% compared to 21% in the prior quarter.

Subscribe to my newsletter

Read articles from Beinsure Media directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Beinsure Media

Beinsure Media

Beinsure.com — digital media platform focused on insurance, InsurTech, cybersecurity, investments, and blockchain technologies. It aims to demystify the complexities of these industries by providing the latest news, ratings, reviews, and insights. Beinsure serves a global audience interested in finance, insurance, and technology, offering an integrated platform for both industry professionals and the general public. The content is curated to inform and educate readers about market trends, investment opportunities, and technological advancements in the insurance and InsurTech sectors. Beinsure is a professional digital outlet that offers comprehensive coverage, in-depth analyses, and trusted reviews, and covers a wide range of topics related to insurance and technology.