Commercial Insurance Rates by Region: Insights from the Global Insurance Market Index

Beinsure Media

Beinsure Media

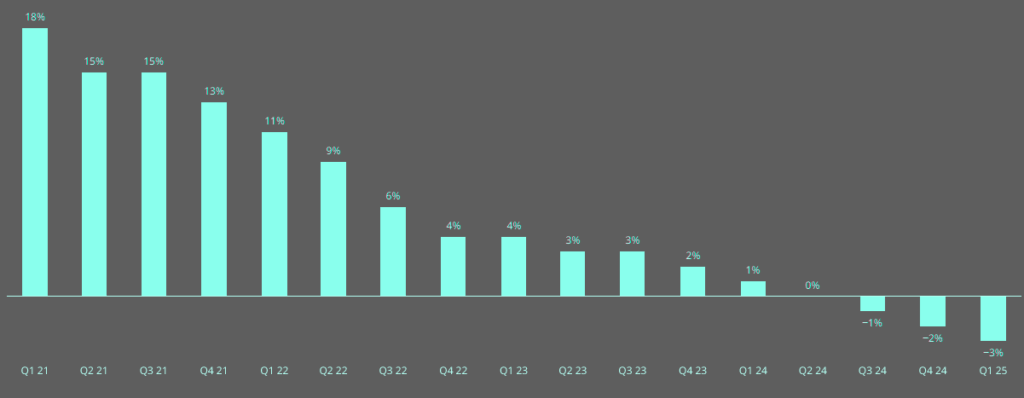

Global commercial insurance rates declined by 3% in Q1 2025, the third consecutive decrease in the composite rate following seven years of increases, according to the Marsh Global Insurance Market Index. Beinsure analyzed the report and highlighted the key points.

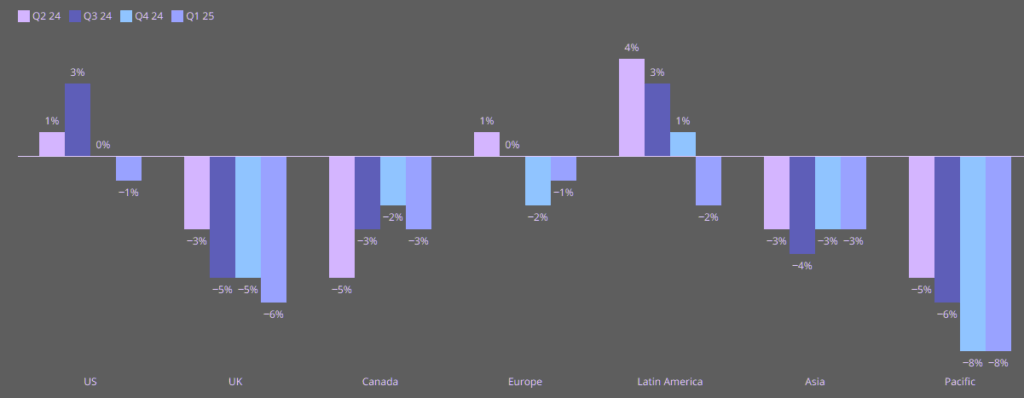

A continuing increase in insurer competition was the main catalyst behind rate trends, which declined globally in every region and across all major product lines other than casualty.

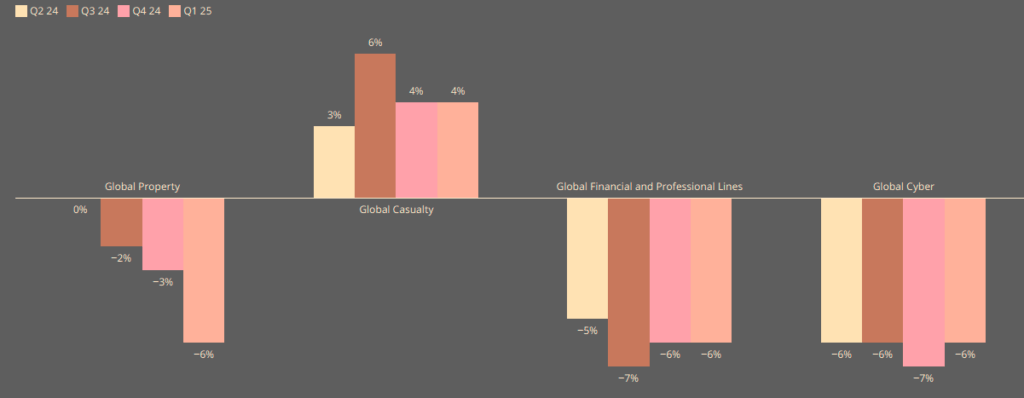

Financial and professional lines rates fell 6% globally, with declines in every region. Cyber insurance also dropped 7%.

Property insurance rates fell 3% globally. Casualty insurance remained the only major category to rise, increasing 4%, compared to 6% in the prior quarter.

Casualty insurance rates increased 4% globally, though the rise slowed from 6% in Q3. U.S. casualty rates had the sharpest increase at 7%, driven by excess/umbrella coverage. Latin America and the Caribbean saw a 5% rise, while other regions ranged from a 2% decline to a 1% increase.

The main product line bucking the trend was US casualty, where rates rose 8% in the first quarter, contributing strongly to a 4% global increase.

In the US, the overall composite rate declined by 1%, driven by a 9% decline in property insurance. Globally, property rates decreased by 6%, including by 9% in the Pacific, 6% in the UK, and low single digits in other regions.

The pace at which rates in some product lines decreased slowed or flattened in some regions compared to prior quarters. For example, financial and professional lines globally declined 6% the same as in the prior quarter; cyber declined 6% compared to a 7% decline in the prior quarter.

Global composite insurance rate change

Source: Marsh Specialty and Global Placement

All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, we have rounded all percentages regarding rate movements to the nearest whole number.

By region, the Pacific recorded the steepest overall decline at 8%, followed by the UK at 5%, Asia at 3%, and Canada and Europe at 2%. Offsetting these decreases, Latin America, the Caribbean, and IMEA saw 1% increases. U.S. rates remained flat in Q4 after rising 3% in Q3.

Global composite insurance rate change – by region

Source: Marsh Specialty and Global Placement

Marsh attributes the trend to increased competition in commercial property insurance, slower casualty rate increases, stable financial lines pricing, and accelerated cyber rate reductions.

The softening of rates across property, financial lines, and cyber is positive for clients, though challenges persist, particularly in U.S. casualty. We remain focused on managing costs, protecting balance sheets, and guiding clients through market shifts

John Donnelly, Global Head of Placement at Marsh

Global product line trends

Source: Marsh Specialty and Global Placement

Property rates declined by 6% globally, with rate movement varying by region. The US and Pacific regions experienced the largest decreases, at -9%; while the UK declined 6% and all other regions experienced low single-digit declines.

Casualty rates increased 4% globally, led by an 8% increase in the US, driven largely by excess/umbrella rates. Other regions varied between 2% increases and 2% decreases.

Financial and professional lines rates decreased 6% globally, declining in every region, including by 10% in the UK and Pacific.

Cyber insurance rates declined 6%, with declines seen in every region, including 10% in Europe.

FULL Report - https://beinsure.com/global-insurance-market-index-pricing-by-region/

Subscribe to my newsletter

Read articles from Beinsure Media directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Beinsure Media

Beinsure Media

Beinsure.com — digital media platform focused on insurance, InsurTech, cybersecurity, investments, and blockchain technologies. It aims to demystify the complexities of these industries by providing the latest news, ratings, reviews, and insights. Beinsure serves a global audience interested in finance, insurance, and technology, offering an integrated platform for both industry professionals and the general public. The content is curated to inform and educate readers about market trends, investment opportunities, and technological advancements in the insurance and InsurTech sectors. Beinsure is a professional digital outlet that offers comprehensive coverage, in-depth analyses, and trusted reviews, and covers a wide range of topics related to insurance and technology.