US Cyber Insurance Premiums Fall Due to Reduced Prices

Beinsure Media

Beinsure Media

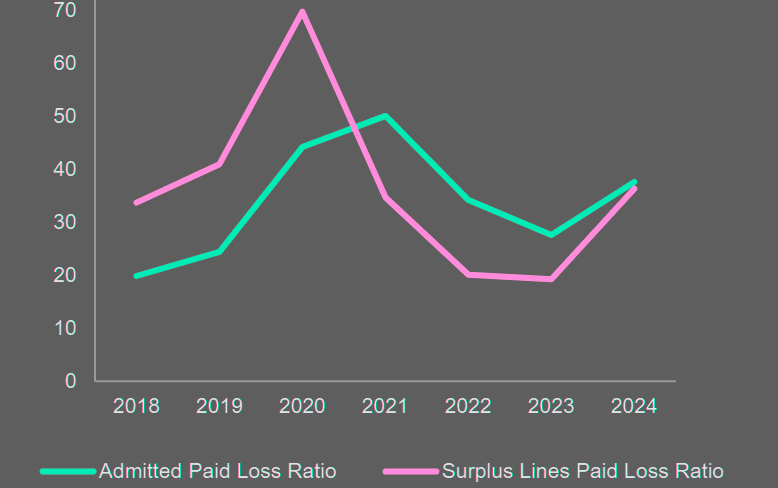

The premium decline matched the year-over-year pricing drop, suggesting little change in cyber risk exposure from 2023 to 2024, but the loss ratio, including defense and cost containment (DCC) expenses, rose due to more claims., according to Beinsure’s Cyber Report.

Direct Premiums Written for Cyber Insurance

In 2024, direct premiums written (DPW) for cyber insurance declined by 2.3% to $7.075bn, down from $7.244bn in 2023. U.S. cyber insurance premium rates decline in 2025. This marks the first annual decrease in cyber insurance premiums since the NAIC began collecting this data in 2015.

Despite this drop, the direct loss ratio remained below 50%, indicating continued profitability for insurers underwriting cyber risk, even with inflationary pressure on losses and lower premium levels.

The decline in DPW primarily reflects reductions in pricing rather than changes in exposure.

According to data from the Council of Insurance Agents and Brokers (CIAB), cyber insurance pricing decreased by an average of 1.6% during the final three quarters of 2024 (see 2025 Global Cyber Risk Report).

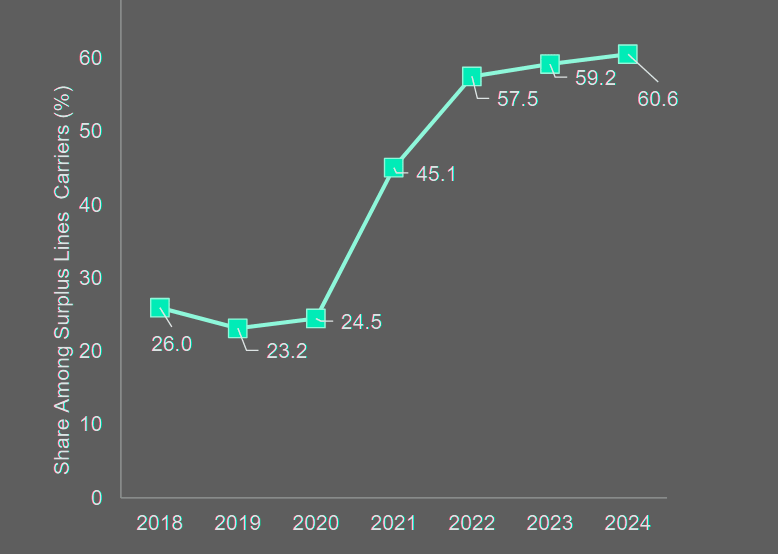

Surplus Lines as Share of all Cyber DPW

Source: AM Best

The similarity between the decline in pricing and the overall drop in premium suggests that demand for cyber coverage remained stable, according to Global Cyber Insurance Industry Trend.

The reduction in premium may also be linked to a trend among large organizations shifting their cyber risk coverage to single-parent captive insurers.

Firms with strong cybersecurity practices and favorable historical loss experience often prefer to retain premiums within their own corporate structure.

Admitted vs Surplus Cyber Paid Loss and DCC Ratio

Source: AM Best

By using captives, these organizations retain the financial benefit of their own performance. Since such captives typically do not report to the NAIC, this activity is not reflected in the cyber insurance supplement.

During the hard market phase, premium growth significantly exceeded pricing increases, indicating rising demand for cyber insurance.

In contrast, the current premium decrease aligns closely with the decline in pricing, further supporting the view that demand remains steady despite the overall market contraction.

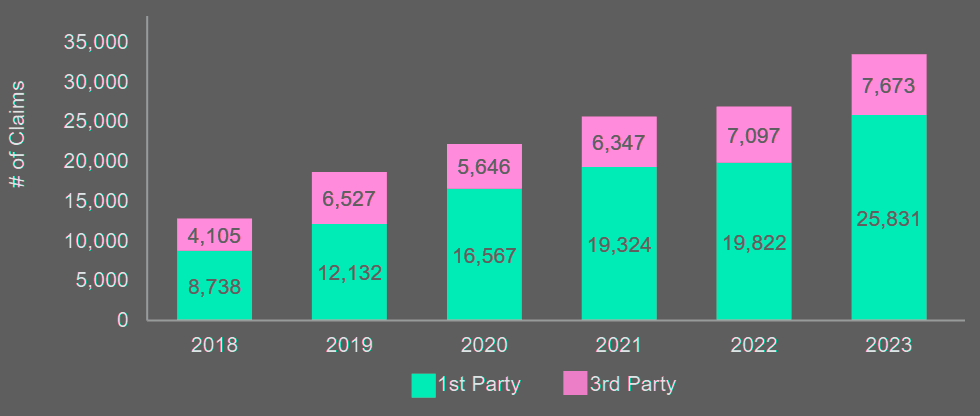

Cyber Insurance Claims

Claims increased significantly in 2024 and are also consistent with the AM Best cyber questionnaire; first-party claims are about 75% of all claims.

Ransomware attacks began accelerating about 5 years ago, and data for traditional actuarial analysis in the form of early development patterns is now becoming available.

We believe there is still a tail on these losses, as litigation and discovery could be more protracted and hacks could be latent for a long time before they are exploited.

Rising litigation activity may extend the claims tail, even for first-party cyber claims, increasing both claim costs due to inflation and legal expenses.

Cyber Claims by Type

Source: AM Best

Policyholders now face exposure not only from their own operations but also through vendor relationships.

Subrogation against a vendor responsible for a loss can be difficult if the vendor lacks sufficient assets, making recovery efforts uneconomical.

Additionally, pursuing subrogation may strain the insured’s vendor relationship. As part of effective cyber risk management, insureds should conduct thorough due diligence on third-party vendors and prepare for such contingencies.

Subscribe to my newsletter

Read articles from Beinsure Media directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Beinsure Media

Beinsure Media

Beinsure.com — digital media platform focused on insurance, InsurTech, cybersecurity, investments, and blockchain technologies. It aims to demystify the complexities of these industries by providing the latest news, ratings, reviews, and insights. Beinsure serves a global audience interested in finance, insurance, and technology, offering an integrated platform for both industry professionals and the general public. The content is curated to inform and educate readers about market trends, investment opportunities, and technological advancements in the insurance and InsurTech sectors. Beinsure is a professional digital outlet that offers comprehensive coverage, in-depth analyses, and trusted reviews, and covers a wide range of topics related to insurance and technology.