Key Trends in the U.S. Auto Insurance Market for 2025

Beinsure Media

Beinsure Media

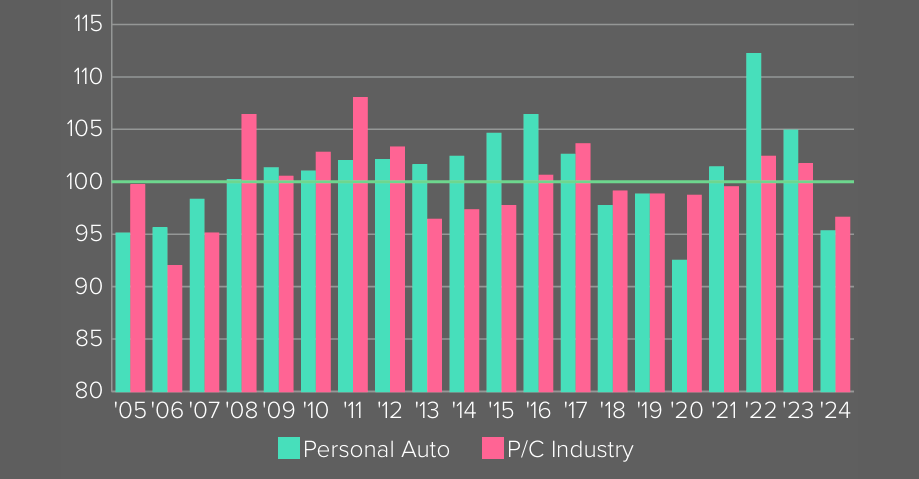

The United States personal auto insurance industry achieved its best underwriting result in the post-pandemic era with a net combined ratio of 95.3 in 2024, according to a Triple-I report. Beinsure analyzed the report and highlighted the key points.

Personal auto insurance underwriting profitability appears to finally be headed in a positive direction after recent years of record underwriting losses. But while these gains show improvement, it will likely take time for them to be reflected in flattening premium rate.

The line which represents more than a third of the industry on a premium basis and twice as much as the next largest line of insurance, has outperformed the net combined ratio of the P&C insurance industry 10 out of the 20 years since 2005.

Insurers’ underwriting profitability is measured by a combined ratio, which is calculated by dividing the sum of claim-related losses and expenses by premium. A combined ratio under 100 indicates a profit. A ratio above 100 indicates a loss.

Personal auto insurance premium

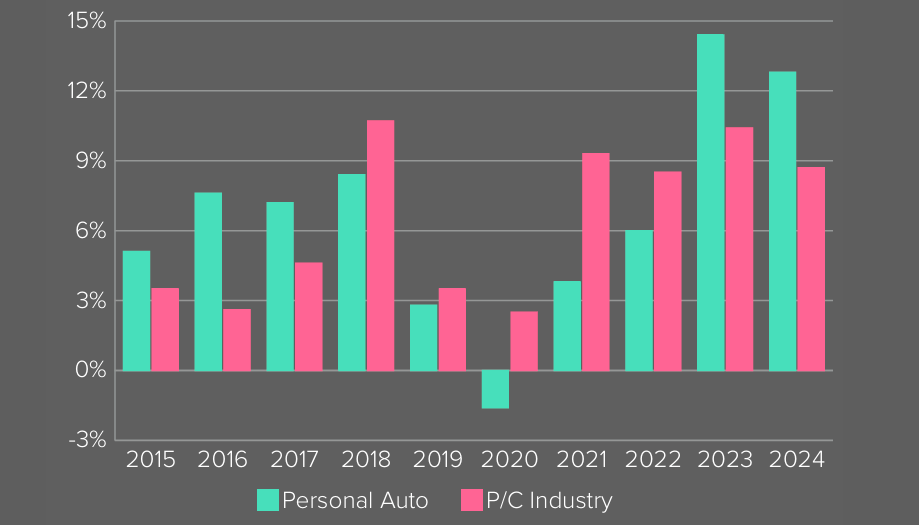

From 2018 to 2022, the net written premium growth rate in the property and casualty insurance industry outpaced that of personal auto.

However, personal auto experienced a marked reversal in 2023 and 2024, recording double-digit growth rates of 14.4% and 12.8%, respectively.

These increases reflect a significant rate recalibration following the effects of the COVID-19 pandemic (see 2025 Personal Auto Insurance Rates).

In 2020, personal auto premiums declined for the first time since 2009. This was the only instance of decline between 2009 and 2024 and coincided with a sharp reduction in total vehicle miles driven due to pandemic-related restrictions across the United States.

While the improved 2024 underwriting performance is encouraging, we remain focused on several challenges facing the personal auto insurance industry.

Sean Kevelighan, Triple-I CEO

“The growing impacts of legal system abuse, driven by the exploitive tactics of billboard attorneys, combined with an increasingly complex regulatory environment, will continue to put pressure on the market. It’s essential for auto insurers to continue managing these evolving risks effectively to sustain profitable growth”, Sean Kevelighan said.

Net Combined Ratio, 2005-2024

Source: S&P Global Market Intelligence

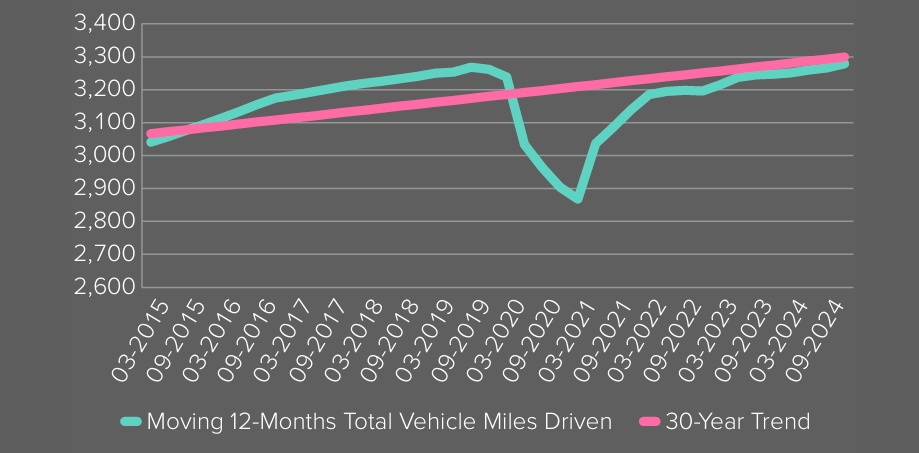

Since then, total vehicle miles driven have returned to align with the 30-year historical trend (see US Auto Insurance Rates by States).

There is a perfect positive correlation between changes in vehicle miles driven before the pandemic, during its onset, and in the post-pandemic period, and the corresponding shifts in net written premium across these same periods.

This relationship highlights the direct influence of driving behavior on premium patterns in the personal auto insurance segment.

Net Written Premium Growth Rate, 2015-2024

Source: S&P Global Market Intelligence

Replacement costs for personal auto—based on indicators such as new and used vehicle prices, motor vehicle parts and equipment, and maintenance and repair services—have risen substantially since the pandemic began. In response, insurers have adjusted rates to reflect these elevated costs (see U.S. Personal Auto Insurers See Strong Recovery).

From 2015 to 2024, year-over-year (YoY) changes in specific Consumer Price Index (CPI) components show strong correlations with the average rate changes implemented by insurance carriers.

These correlations exceed 70%, highlighting the connection between inflationary trends in auto-related goods and services and pricing strategies in the insurance sector.

Total Vehicle Miles Driven (mn), 2015-2024

Source: US Department of Transportation

The correlation between the YoY CPI change for new vehicles and insurance rate adjustments is 88% when the CPI data is shifted forward by one year.

For motor vehicle parts and equipment, the correlation reaches 74% under the same one-year forward shift. Used vehicle CPI changes show a 79% correlation when shifted forward by two years.

The YoY CPI change for motor vehicle maintenance and repair aligns with insurance rate changes at a 78% correlation, without the need for a time shift.

……….

FULL Report - https://beinsure.com/us-personal-auto-insurance-market-trends/

Subscribe to my newsletter

Read articles from Beinsure Media directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by

Beinsure Media

Beinsure Media

Beinsure.com — digital media platform focused on insurance, InsurTech, cybersecurity, investments, and blockchain technologies. It aims to demystify the complexities of these industries by providing the latest news, ratings, reviews, and insights. Beinsure serves a global audience interested in finance, insurance, and technology, offering an integrated platform for both industry professionals and the general public. The content is curated to inform and educate readers about market trends, investment opportunities, and technological advancements in the insurance and InsurTech sectors. Beinsure is a professional digital outlet that offers comprehensive coverage, in-depth analyses, and trusted reviews, and covers a wide range of topics related to insurance and technology.