U.S. Healthcare Information System Market: How Hospitals are Leading the Charge?

Georgie Bill

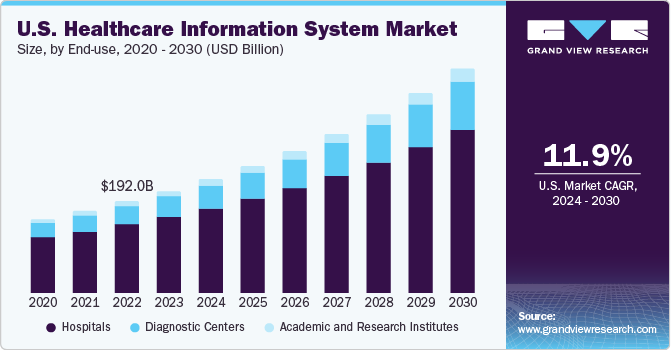

Georgie BillThe U.S. healthcare information system market was valued at USD 213.93 billion in 2023 and is projected to reach USD 470.3 billion by 2030, growing at a CAGR of 11.97% from 2024 to 2030. The increasing prevalence of chronic diseases such as diabetes, cancer, and congestive heart failure is significantly contributing to the rising adoption of remote patient monitoring across the country. This growing trend is expected to fuel demand for IT-based healthcare solutions in the U.S.

Healthcare information systems offer a variety of benefits, including operational cost reductions, fewer medical errors, and improved clinical outcomes. These advantages are anticipated to drive the industry’s growth over the forecast period. Additionally, government initiatives aimed at enhancing healthcare infrastructure and promoting the integration of IT into existing healthcare facilities are likely to further accelerate market expansion.

A key factor supporting the widespread adoption of healthcare information systems is the increase in global and domestic government-led initiatives focused on developing and deploying advanced health IT. In the U.S., the growing burden of chronic illnesses is expected to raise the need for healthcare IT solutions that improve Chronic Disease Management (CDM), enabling better patient monitoring, diagnosis, and treatment.

Order a free sample PDF of the U.S. Healthcare Information System Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

By Application: In 2023, revenue cycle management dominated the healthcare information systems market, accounting for approximately 73.0% of total revenue. The growing need to reduce medical billing errors, streamline reimbursements, and optimize workflow in healthcare facilities is driving demand for synchronized management systems.

By Deployment: Web-based deployment models led the market in 2023 with a 45.0% share. These systems are preferred for their scalability, accessibility, and cost-effectiveness. They enable healthcare professionals to access patient data remotely, reduce reliance on hardware infrastructure, and integrate smoothly with various healthcare technologies.

By Component: Healthcare information services were the leading segment, contributing nearly 40.0% of total market revenue in 2023. The rise of digital health solutions and connected care models, supported by technological advancements in software and hardware, is increasing demand for services that enable monitoring, diagnosis, and disease prevention.

By End-Use: Hospitals emerged as the primary end-users of healthcare information systems in the U.S., accounting for over 75.0% of market share in 2023. Interoperable systems allow hospitals to efficiently share health data, improving decision-making and patient care. The cost-efficiency and scalability of web-based IT systems also make them highly adaptable to hospitals’ evolving technological needs.

Market Size & Forecast

2023 Market Size: USD 213.93 Billion

2030 Projected Market Size: USD 470.3 Billion

CAGR (2024-2030): 11.97%

Key Companies & Market Share Insights

The U.S. healthcare information system market is consolidated, with major players actively engaging in strategic collaborations, mergers, and acquisitions to strengthen their market positions and capture untapped opportunities.

Key companies are focused on expanding service portfolios, entering new markets, and enhancing operational efficiency through scale. For example, in November 2021, Athenahealth was acquired by private equity firms Hellman & Friedman and Bain Capital. The company, which serves over 140,000 ambulatory care providers across all 50 U.S. states and 120+ specialties, aimed to build a comprehensive digital care network connecting patients, payers, and providers post-acquisition.

Key Players

Cerner Corporation

Athenahealth Inc.

Change Healthcare Inc.

GE Healthcare

IBM

Oracle Corporation

Dell Technologies Inc.

Philips Healthcare

Optum

Infor

Epic Systems Corporation

Allscripts Healthcare Solutions Inc.

Conduent Inc.

Cognizant Technology Solutions Corporation

eClinicalWorks LLC

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. healthcare information system market is poised for significant expansion through 2030, with a projected CAGR of 11.97%. Rising rates of chronic illnesses, increasing adoption of remote patient monitoring, and strong government support for healthcare IT infrastructure are key drivers of growth. Hospitals remain the primary users of these systems, while web-based deployments and revenue cycle management applications lead in adoption. With ongoing technological advancements and strategic investments by major players, the market is expected to see continued innovation, improved efficiency in healthcare delivery, and enhanced patient outcomes over the coming years.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by