Comparing Strategies: DCA vs. Grid Trading

Aleks

Aleks

The revolution of automated trading has reached unprecedented levels in 2025. Algorithmic trading accounted for about 60–73% of all U.S. stock trading in 2018, and today that figure has grown even more significantly. Retail investors now represent 43.1% of the algorithmic trading market in 2025, marking a dramatic shift from institutional dominance to widespread adoption of automated strategies.

Democratization of Complex Strategies

What was once the privilege of elite hedge funds and major banks is now available to every trader. 91% of financial institutions either already use or plan to implement cloud services, creating a technological infrastructure that makes professional trading tools accessible to retail investors. The AI trading platform market is growing at a 20.04% CAGR between 2025 and 2034, underlining the rapid adoption of intelligent trading solutions. The cryptocurrency market has become the perfect sandbox for experimenting with automated strategies. By 2025, 28% of U.S. adults (about 65 million people) own cryptocurrencies - nearly double the number at the end of 2021. This growing user base increasingly relies on trading bots to navigate the highly volatile digital asset environment.

Volatility as a Catalyst for Innovation

The 2025 crypto market is marked by unprecedented volatility, creating both opportunities and challenges. The total cryptocurrency market cap surpassed $3.85 trillion as of July 24, while Bitcoin dominance dropped to 61.1% from 65.1% in June 2025, signaling capital rotation into altcoins. It is precisely this volatility that makes systematic approaches essential. The main concerns that prevent some Americans from owning cryptocurrency are unstable markets, volatile token values, and fluctuating exchange rates. Automated strategies such as Dollar-Cost Averaging (DCA) and Grid Trading offer ways to reduce the emotional impact of price swings.

A Technological Renaissance of Trading Bots

DCA crypto bots have gained massive popularity by automating the DCA strategy, allowing investors to set predefined rules and minimize manual intervention. At the same time, Grid trading strategies remain highly in demand, keeping Grid bots at the forefront of automated trading. Modern platforms now provide unprecedented flexibility. For example, Pionex offers 16+ free built-in trading bots, including Grid Trading, arbitrage, Trailing Buy/Sell, and DCA bots. This ecosystem empowers traders to experiment with different strategies without significant upfront investment.

Institutional Recognition and Regulatory Clarity

2025 has also seen major regulatory shifts, creating a more stable environment for automated trading. In Q1 2025, crypto venture funding rebounded strongly, reaching $4.8 billion, the highest since Q3 2022. In this dynamic environment, two strategies stand out as the most popular and effective: Dollar-Cost Averaging (DCA) and Grid Trading. Each represents a unique approach to automated trading, with its own advantages, risks, and optimal conditions. Understanding their differences - and implementing them in Go (Golang) - will be critical for success in the era of algorithmic dominance.

Dollar-Cost Averaging: The Quintessence of Disciplined Investing

The Dollar-Cost Averaging (DCA) strategy represents the quintessence of disciplined investing, where emotions give way to mathematical precision. First conceptualized by Benjamin Graham in his legendary 1949 work The Intelligent Investor, DCA has become a cornerstone of modern portfolio management - particularly in the highly volatile cryptocurrency market.

Foundations of the Strategy

The philosophical foundation of DCA lies in the principle of systematically reducing time-related investment risk. Instead of trying to "catch the bottom" of the market - a task that remains unsolvable even for professional fund managers - the strategy suggests dividing investment capital into equal portions and allocating them at regular intervals. Research shows that traditional application of DCA in the S&P 500 index delivers an average annual return of around 7.8%, while significantly reducing psychological pressure on investors. In the crypto space, DCA's effectiveness grows exponentially - analysis shows that a 5-year Bitcoin DCA strategy yields a return of 202%, compared to just 34% for gold under the same approach. The psychological aspect of DCA cannot be overstated. The strategy eliminates key cognitive biases: regret aversion (fear of missing the best moment), self-control issues (impulsive decisions), and the disposition effect (holding onto losing positions). 63% of crypto holders report losses due to emotional decisions, with NBER studies confirming that even professional traders exhibit significant autonomous reactions to market events.

Mechanics of a DCA Bot

Modern DCA bot architecture is built on the principles of event-driven programming and finite-state machines. The core algorithm includes three critical components: a market monitoring system, an order execution module, and a risk management mechanism.

package strategy

import (

"context"

"time"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/internal/portfolio"

)

type DCAStrategy struct {

// Core strategy parameters

Symbol string `json:"symbol"`

BaseOrderSize float64 `json:"base_order_size"`

SafetyOrderSize float64 `json:"safety_order_size"`

SafetyOrdersCount int `json:"safety_orders_count"`

PriceDeviation float64 `json:"price_deviation"` // % для размещения safety ордеров

TakeProfitPercent float64 `json:"take_profit_percent"`

// Internal condition

CurrentOrders []types.Order `json:"current_orders"`

AveragePrice float64 `json:"average_price"`

TotalInvested float64 `json:"total_invested"`

TotalQuantity float64 `json:"total_quantity"`

IsActive bool `json:"is_active"`

// Dependencies

portfolioManager *portfolio.Manager

riskManager RiskManager

}

// Execute runs the main DCA strategy logic

func (d *DCAStrategy) Execute(ctx context.Context, market types.MarketData) error {

// Checking the conditions for entering into a transaction

if !d.IsActive {

return d.initiateFirstOrder(ctx, market)

}

// The logic of placing safety orders when the price drops

if d.shouldPlaceSafetyOrder(market.Price) {

return d.placeSafetyOrder(ctx, market)

}

// Checking the conditions for take profit

if d.shouldTakeProfit(market.Price) {

return d.executetakeProfit(ctx, market)

}

return nil

}

// initiateFirstOrder places the initial order

func (d *DCAStrategy) initiateFirstOrder(ctx context.Context, market types.MarketData) error {

// Validation of position size according to risk management

if !d.riskManager.CanTrade(d.BaseOrderSize, d.Symbol) {

return errors.New("risk limits exceeded for initial order")

}

order := types.Order{

Symbol: d.Symbol,

Side: types.BUY,

Type: types.MARKET,

Quantity: d.BaseOrderSize / market.Price,

Price: market.Price,

Timestamp: time.Now(),

}

// Updating the internal state

d.updatePosition(order)

d.IsActive = true

return d.portfolioManager.PlaceOrder(ctx, order)

}

Averaging the position occurs by dynamically recalculating the weighted average entry price. Each new safety order reduces the overall cost of ownership, improving the conditions for reaching profitability.

New Average Price = (Current Position × Old Price + New Purchase × Purchase Price) / Total Quantity

The risk management system provides several layers of protection:

package portfolio

type RiskManager struct {

MaxDrawdown float64 `json:"max_drawdown"`

MaxPositionSize float64 `json:"max_position_size"`

DailyLossLimit float64 `json:"daily_loss_limit"`

// Dynamic parameters

currentDrawdown float64

dailyPnL float64

positionSizes map[string]float64

}

func (r *RiskManager) CanTrade(orderSize float64, symbol string) bool {

if r.currentDrawdown >= r.MaxDrawdown {

return false

}

if r.positionSizes[symbol]+orderSize > r.MaxPositionSize {

return false

}

if r.dailyPnL <= -r.DailyLossLimit {

return false

}

return true

}

Optimal Conditions for Application

The DCA strategy demonstrates maximum effectiveness in bear markets and recovery periods. Research shows that during the 2022–2024 crash, DCA investors making $500 monthly contributions achieved 188.5% returns ($18,000 → $51,929), significantly outperforming lump-sum investors, with a max drawdown of just 45% versus 77% for those trying to time the market. Long-term perspective is critical to DCA's success. Over a 7-year period, Bitcoin DCA with $200/month delivered $119,300 in profits, while Ethereum yielded $97,200. The Sharpe ratio for Bitcoin DCA ranges between 1.45–1.85over 5 years, nearly double that of the S&P 500 (0.85). The risk profile of DCA makes it ideal for conservative investors. The strategy reduces portfolio volatility by 40% compared to active trading, while maintaining long-term growth potential. Automation through bots eliminates the need for constant market monitoring - especially valuable for investors with limited time.

strategies:

conservative_btc:

symbol: "BTCUSDT"

base_order_size: 100.0

safety_order_size: 100.0

safety_orders_count: 3

price_deviation: 3.0

take_profit_percent: 1.5

aggressive_eth:

symbol: "ETHUSDT"

base_order_size: 200.0

safety_order_size: 150.0

safety_orders_count: 5

price_deviation: 2.0

take_profit_percent: 2.5

altcoin_speculative:

symbol: "SOLUSDT"

base_order_size: 50.0

safety_order_size: 75.0

safety_orders_count: 7

price_deviation: 5.0

take_profit_percent: 3.0

Modern adaptive DCA bots integrate technical indicators to optimize entries. Reddit-based research shows a 47% improvement in ROI when using the Fear & Greed Index ($150 buys at "extreme fear," $25 at "extreme greed"), achieving 184.2% versus 124.8% under the classic method. By 2025, the DCA strategy stands as a sophisticated automated investing tool that combines psychological resilience, mathematical precision, and technological efficiency. A proper Go-based implementation, using modern design patterns and comprehensive risk management, makes DCA the optimal choice for long-term accumulation of crypto assets in volatile markets.

Grid Trading: The Art of Trading in Ranges

The philosophical foundation of Grid Trading is based on a fundamental principle of financial markets - prices never move in a straight line. Even in the strongest trends, there are corrections, pullbacks, and consolidations. Grid strategy systematically monetizes these natural fluctuations by placing buy and sell orders within a predefined price range. Modern research shows that realistic returns from Grid Trading range between 15–50% annually with proper configuration. The Federal Reserve Bank of Kansas City confirms that the volatility of the cryptocurrency market requires careful risk management, making the Grid approach especially relevant for retail investors. Types of grids differ in how price levels are distributed:

Arithmetic Grid: Even spacing with fixed intervals.

Geometric Grid: Logarithmic spacing that adapts to percentage changes in price.

Studies by the Stevens Institute show that geometric grids demonstrate superior performance under high volatility, particularly in Bitcoin trading, where a gradual upward trend is combined with frequent corrections.

Grid Bot Algorithm

The architecture of a modern Grid bot is a sophisticated state management system that dynamically responds to market conditions. Core components include the grid calculator, order manager, and profit tracking engine.

package strategy

import (

"context"

"math"

"sync"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/pkg/utils"

)

type GridStrategy struct {

// Basic Grid Parameters

Symbol string `json:"symbol"`

UpperBound float64 `json:"upper_bound"` // Upper limit of the range

LowerBound float64 `json:"lower_bound"` // The lower limit of the range

GridLevels int `json:"grid_levels"` // Number of grid levels

OrderSize float64 `json:"order_size"` // The size of each order

GridType GridType `json:"grid_type"` // ARITHMETIC or GEOMETRIC

// Internal condition

ActiveOrders map[float64]types.Order `json:"active_orders"`

GridSpacing float64 `json:"grid_spacing"`

TotalProfit float64 `json:"total_profit"`

TradeCount int `json:"trade_count"`

// Syncing for concurrent access

mutex sync.RWMutex

// Dependencies

portfolioManager *portfolio.Manager

riskManager RiskManager

}

type GridType string

const (

ARITHMETIC GridType = "arithmetic"

GEOMETRIC GridType = "geometric"

)

// Execute implements the basic logic of the Grid strategy

func (g *GridStrategy) Execute(ctx context.Context, market types.MarketData) error {

g.mutex.Lock()

defer g.mutex.Unlock()

// Checking whether the price is within the grid

if !g.isPriceInRange(market.Price) {

return g.handlePriceOutOfRange(ctx, market)

}

// Execution of transactions when reaching the grid levels

return g.processGridLevels(ctx, market)

}

// calculateGridLevels calculates all the levels of the grid

func (g *GridStrategy) calculateGridLevels() []float64 {

levels := make([]float64, g.GridLevels)

switch g.GridType {

case ARITHMETIC:

g.GridSpacing = (g.UpperBound - g.LowerBound) / float64(g.GridLevels-1)

for i := 0; i < g.GridLevels; i++ {

levels[i] = g.LowerBound + float64(i)*g.GridSpacing

}

case GEOMETRIC:

ratio := math.Pow(g.UpperBound/g.LowerBound, 1.0/float64(g.GridLevels-1))

for i := 0; i < g.GridLevels; i++ {

levels[i] = g.LowerBound * math.Pow(ratio, float64(i))

}

}

return levels

}

// processGridLevels handles the activation of grid levels

func (g *GridStrategy) processGridLevels(ctx context.Context, market types.MarketData) error {

levels := g.calculateGridLevels()

currentPrice := market.Price

for _, level := range levels {

// Checking the purchase level activation

if g.shouldBuyAtLevel(level, currentPrice) {

if err := g.placeBuyOrder(ctx, level); err != nil {

return err

}

}

// Checking the activation of the sales level

if g.shouldSellAtLevel(level, currentPrice) {

if err := g.placeSellOrder(ctx, level); err != nil {

return err

}

}

}

return nil

}

The grid structure is built on mathematical principles of optimal liquidity allocation. Each level represents a potential profit point, where the difference between buy and sell prices provides a minimal but systematic margin. An automatic reinvestment system creates compounding effects:

package strategy

type ReinvestmentEngine struct {

reinvestmentRate float64 // Percentage of profit for reinvestment

profitThreshold float64 // Minimum profit to trigger

compoundingPeriod time.Duration

}

// ProcessProfit handles earned profits

func (re *ReinvestmentEngine) ProcessProfit(profit float64, gridStrategy *GridStrategy) error {

if profit < re.profitThreshold {

return nil

}

// Calculation of the amount for reinvestment

reinvestAmount := profit * re.reinvestmentRate

// The increase in the size of orders is proportional to the profit

newOrderSize := gridStrategy.OrderSize * (1 + reinvestAmount/gridStrategy.getTotalCapital())

// Updating the strategy parameters

gridStrategy.OrderSize = newOrderSize

return gridStrategy.recalculateGrid()

}

Ideal Market Conditions

Grid Trading demonstrates maximum efficiency in sideways markets and during high volatility periods. Research shows that pairs such as BTC/USDT, ETH/USDT, and SOL/USDT with daily volumes of $14B+ and volatility of 12–25% provide the most favorable conditions. High volatility is the critical success factor. Assets with monthly movements exceeding 30% may breach grid boundaries, but with proper adjustment, this creates opportunities for multiple profit cycles. Modern adaptive grid bots use Average True Range (ATR) for dynamic parameter tuning:

package indicators

import "crypto-trading-strategies/pkg/types"

type ATRIndicator struct {

period int

values []float64

smoothing float64

}

// Calculate calculates the ATR to adapt the Grid parameters

func (atr *ATRIndicator) Calculate(candles []types.Candle) float64 {

if len(candles) < atr.period {

return 0

}

trueRanges := make([]float64, len(candles)-1)

for i := 1; i < len(candles); i++ {

high := candles[i].High

low := candles[i].Low

prevClose := candles[i-1].Close

trueRange := math.Max(

high-low,

math.Max(

math.Abs(high-prevClose),

math.Abs(low-prevClose),

),

)

trueRanges[i-1] = trueRange

}

return atr.exponentialMovingAverage(trueRanges)

}

// AdaptGridSpacing adapts the distance between levels

func (g *GridStrategy) AdaptGridSpacing(atr float64) {

// Setting spacing as a percentage of ATR (10-20%)

optimalSpacing := atr * 0.15

// Recalculating the number of levels to maintain the range

g.GridLevels = int((g.UpperBound - g.LowerBound) / optimalSpacing)

g.GridSpacing = optimalSpacing

}

Short-term trading with frequent small gains lies at the heart of the Grid approach. When properly configured, the system can generate 0.1–0.3% daily profits in conservative setups, and up to 1% in aggressive ones - though higher returns require intensive management.

strategies:

conservative_btc:

symbol: "BTCUSDT"

upper_bound: 72000.0

lower_bound: 58000.0

grid_levels: 20

order_size: 0.001

grid_type: "arithmetic"

aggressive_eth:

symbol: "ETHUSDT"

upper_bound: 4200.0

lower_bound: 2800.0

grid_levels: 35

order_size: 0.05

grid_type: "geometric"

scalping_sol:

symbol: "SOLUSDT"

upper_bound: 180.0

lower_bound: 120.0

grid_levels: 50

order_size: 2.0

grid_type: "arithmetic"

reinvestment_rate: 0.8

Modern adaptive Grid systems integrate machine learning to predict optimal parameters. Research from the FE800 project in collaboration with Quantm Capital shows that Random Forest and LSTM models can dynamically tune Grid bot parameters - though traditional methods often yield comparable results with less complexity. By 2025, Grid Trading stands as a sophisticated profit-extraction tool that leverages market volatility. It requires a deep understanding of market microstructure, precise mathematical configuration, and continuous performance monitoring. A proper Go-based implementation, using concurrent patterns and advanced risk management, turns Grid strategy into a powerful weapon in the arsenal of the modern algorithmic trader.

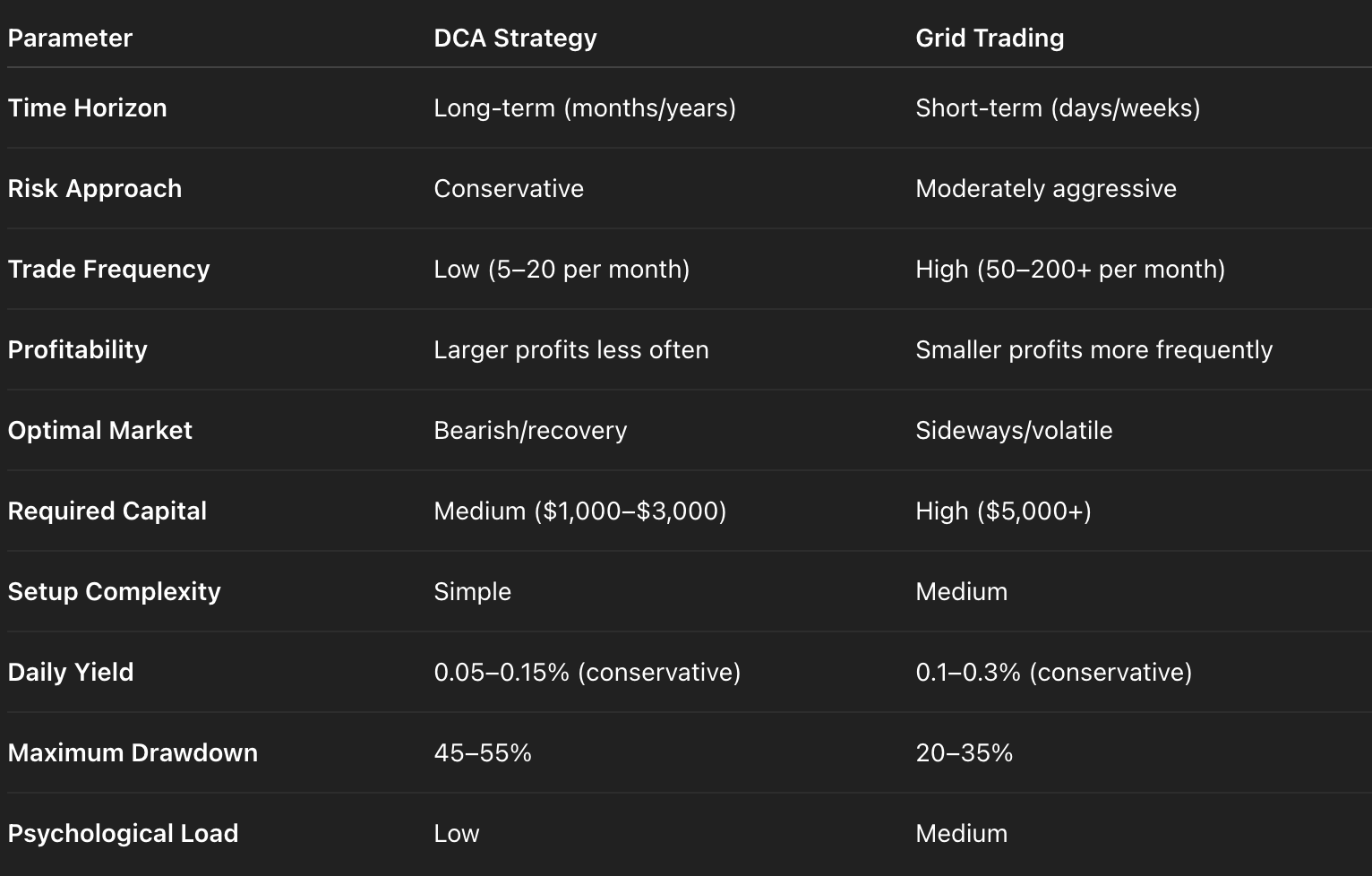

Comparative Analysis of Strategies

After a detailed examination of the philosophy and mechanisms of DCA and Grid Trading, it is critically important to conduct an objective comparison of their effectiveness in real market conditions. Modern 2025 backtesting data provides a unique opportunity to evaluate the performance of both strategies through the lens of current market cycles.

Critical architectural differences are revealed in the approach to position management:

package backtest

import (

"time"

"crypto-trading-strategies/pkg/types"

)

type StrategyComparison struct {

DCAResults PerformanceMetrics `json:"dca_results"`

GridResults PerformanceMetrics `json:"grid_results"`

Period time.Duration `json:"backtest_period"`

MarketType MarketCondition `json:"market_condition"`

}

type PerformanceMetrics struct {

TotalReturn float64 `json:"total_return"` // %

AnnualizedReturn float64 `json:"annualized_return"` // %

MaxDrawdown float64 `json:"max_drawdown"` // %

SharpeRatio float64 `json:"sharpe_ratio"`

TradeCount int `json:"trade_count"`

WinRate float64 `json:"win_rate"` // %

TotalFees float64 `json:"total_fees"` // USD

VolatilityImpact float64 `json:"volatility_impact"` // %

}

type MarketCondition string

const (

BEAR_MARKET MarketCondition = "bear"

BULL_MARKET MarketCondition = "bull"

SIDEWAYS_MARKET MarketCondition = "sideways"

HIGH_VOLATILITY MarketCondition = "high_vol"

)

// CompareStrategies performs comparative analysis of strategies

func (engine *BacktestEngine) CompareStrategies(

symbol string,

startDate, endDate time.Time,

initialBalance float64,

) (*StrategyComparison, error) {

// Determining market conditions

marketCondition := engine.analyzeMarketCondition(symbol, startDate, endDate)

// DCA Strategy Backtest

dcaConfig := &DCAConfig{

BaseOrderSize: initialBalance * 0.1,

SafetyOrderSize: initialBalance * 0.05,

SafetyOrdersCount: 5,

PriceDeviation: 3.0,

TakeProfitPercent: 2.0,

}

dcaResults, err := engine.BacktestDCA(symbol, startDate, endDate, dcaConfig)

if err != nil {

return nil, err

}

// Grid Strategy Backtest

gridConfig := &GridConfig{

GridLevels: 20,

OrderSize: initialBalance * 0.05,

GridType: GEOMETRIC,

TakeProfitPct: 1.0,

}

gridResults, err := engine.BacktestGrid(symbol, startDate, endDate, gridConfig)

if err != nil {

return nil, err

}

return &StrategyComparison{

DCAResults: dcaResults,

GridResults: gridResults,

Period: endDate.Sub(startDate),

MarketType: marketCondition,

}, nil

}

Performance Analysis

Revolutionary 2025 backtesting results have radically changed the understanding of both strategies' effectiveness. Cointelegraph research, based on a 180-day period (October 2024 - April 2025), revealed surprising outcomes: DCA Bot Performance:

BTC/USDT: Underperformed buy-and-hold (34% vs market return)

ETH/USDT: Dramatically outperformed (-25% market vs positive DCA returns)

SOL/USDT: Exceptional performance (-18% market vs significant DCA gains)

Grid Bot Excellence in Downtrends:

BTC: +9.6% vs -16% buy-and-hold

ETH: +10.4% vs -53% buy-and-hold

SOL: +21.88% vs -49% buy-and-hold

These findings demonstrate a fundamental shift in understanding of strategy applicability. Grid bots showed exceptional efficiency in downtrends and high volatility, turning negative market returns into double-digit profits. Impact of Fees on Final Profitability remains a critical factor:

package backtest

type FeeImpactAnalysis struct {

Strategy string `json:"strategy"`

TradeFrequency int `json:"trades_per_month"`

AvgFeeRate float64 `json:"average_fee_rate"` // %

MonthlyFeeCost float64 `json:"monthly_fee_cost"` // USD

FeeToReturnRatio float64 `json:"fee_to_return_ratio"` // %

OptimalMinProfit float64 `json:"optimal_min_profit"` // % per trade

}

// CalculateFeeImpact analyzes the impact of commissions on profitability

func CalculateFeeImpact(strategy string, monthlyTrades int, avgFee float64, monthlyReturn float64) *FeeImpactAnalysis {

monthlyFeeCost := float64(monthlyTrades) * avgFee

feeToReturnRatio := (monthlyFeeCost / monthlyReturn) * 100

// Minimum profit to cover fees + risk

optimalMinProfit := (avgFee * 2.5) // 2.5x Commission coverage

return &FeeImpactAnalysis{

Strategy: strategy,

TradeFrequency: monthlyTrades,

AvgFeeRate: avgFee,

MonthlyFeeCost: monthlyFeeCost,

FeeToReturnRatio: feeToReturnRatio,

OptimalMinProfit: optimalMinProfit,

}

}

Real Platform Fee Analysis:

Pionex: 0.05% per trade (Grid-friendly)

Binance: up to 0.10% (DCA-friendly)

Grid strategies are especially fee-sensitive due to their high trading frequency. At 100 trades per month and a 0.1% fee, monthly costs reach 10% of capital - making the choice of low-fee exchanges critically important.

Psychological Aspects

The DCA strategy functions as a psychological stabilizer, removing key emotional factors from trading. Studies show a 40% stress reduction among DCA bot users compared to active traders. Its systematic approach eliminates FOMO (Fear of Missing Out) and panic-driven behavior. Key Psychological Advantages of DCA:

Eliminates the need to "catch the bottom"

Reduces regret-aversion

Automates discipline

Long-term focus vs short-term emotions

Grid Trading requires higher engagement and resilience to frequent P&L swings. Traders must be ready for daily monitoring and parameter adjustments. Psychological Challenges of Grid Trading:

Constant monitoring of multiple positions

Stress from frequent trade notifications

Need for quick reaction to changing market conditions

Risk of over-optimization and excessive interference

package analytics

type PsychologicalMetrics struct {

Strategy string `json:"strategy"`

StressLevel float64 `json:"stress_level"` // 1-10 scale

MonitoringFrequency int `json:"monitoring_per_day"` // times per day

DecisionFatigue float64 `json:"decision_fatigue"` // 1-10 scale

SleepQualityImpact float64 `json:"sleep_impact"` // 1-10 scale

OverallSatisfaction float64 `json:"satisfaction"` // 1-10 scale

}

// EvaluatePsychologicalImpact evaluates the psychological impact of a strategy

func EvaluatePsychologicalImpact(strategy string, userProfile UserProfile) *PsychologicalMetrics {

var stress, monitoring, fatigue, sleepImpact, satisfaction float64

switch strategy {

case "DCA":

stress = 2.5

monitoring = 1

fatigue = 1.5

sleepImpact = 1.2

satisfaction = 8.5

case "GRID":

stress = 6.5

monitoring = 8

fatigue = 7.0

sleepImpact = 5.5

satisfaction = 7.2

}

// Adjustment based on the user's profile

if userProfile.ExperienceLevel == "BEGINNER" {

stress += 2.0

fatigue += 1.5

}

return &PsychologicalMetrics{

Strategy: strategy,

StressLevel: stress,

MonitoringFrequency: int(monitoring),

DecisionFatigue: fatigue,

SleepQualityImpact: sleepImpact,

OverallSatisfaction: satisfaction,

}

}

The 2025 comparative analysis confirms the fundamental differences between DCA and Grid Trading that go far beyond simple return comparisons. DCA offers psychological comfort and long-term stability at the cost of potentially lower short-term profitability. Grid Trading delivers superior performance in volatile conditions but demands significantly more resources - both financial and psychological. The choice between strategies should be based not only on historical performance but also on a realistic self-assessment of resources, time, and risk tolerance. Modern portfolio theory suggests that an optimal solution may be a hybrid approach, combining the stability of DCA with the opportunistic application of Grid strategies under favorable market conditions.

Technical Implementation in Go

Modern trading bot architecture requires a balance between performance, reliability, and scalability. Go provides the ideal ecosystem for building high-performance trading systems thanks to its built-in concurrency support, efficient memory management, and rich standard library. A professional implementation of DCA and Grid strategies should follow SOLID principles, use dependency injection, and provide comprehensive error handling.

Trading Bot Architecture

The fundamental architecture is based on Clean Architecture principles with clear separation of layers. The Domain layer contains business logic for strategies, the Application layer coordinates use cases, and the Infrastructure layerensures integration with external systems.

package strategy

import (

"context"

"crypto-trading-strategies/pkg/types"

)

type Strategy interface {

Execute(ctx context.Context, market types.MarketData) error

GetSignal(market types.MarketData) types.Signal

ValidateConfig() error

GetMetrics() types.StrategyMetrics

Shutdown(ctx context.Context) error

}

type StrategyFactory interface {

CreateDCA(config types.DCAConfig) (Strategy, error)

CreateGrid(config types.GridConfig) (Strategy, error)

CreateCombo(config types.ComboConfig) (Strategy, error)

}

The core application structure ensures orchestration of all components:

package main

import (

"context"

"os"

"os/signal"

"syscall"

"crypto-trading-strategies/internal/app"

"crypto-trading-strategies/internal/config"

"crypto-trading-strategies/internal/logger"

)

type TradingApplication struct {

config *config.Config

logger *logger.Logger

strategies map[string]strategy.Strategy

exchanges map[string]exchange.Client

portfolio *portfolio.Manager

metrics *metrics.Server

}

func main() {

cfg, err := config.Load()

if err != nil {

log.Fatal("Failed to load config:", err)

}

app := NewTradingApplication(cfg)

ctx, cancel := context.WithCancel(context.Background())

defer cancel()

// Graceful shutdown handling

sigChan := make(chan os.Signal, 1)

signal.Notify(sigChan, syscall.SIGINT, syscall.SIGTERM)

go func() {

<-sigChan

app.logger.Info("Shutdown signal received")

cancel()

}()

if err := app.Run(ctx); err != nil {

app.logger.Error("Application failed:", err)

os.Exit(1)

}

}

A dependency injection container ensures loose coupling and testability:

package app

type Container struct {

config *config.Config

logger *logger.Logger

exchangeClients map[string]exchange.Client

strategyFactory strategy.Factory

portfolioManager *portfolio.Manager

riskManager *risk.Manager

metricsCollector *metrics.Collector

}

func NewContainer(cfg *config.Config) (*Container, error) {

logger := logger.NewStructuredLogger(cfg.Logger)

exchangeClients, err := initializeExchanges(cfg.Exchanges)

if err != nil {

return nil, fmt.Errorf("failed to initialize exchanges: %w", err)

}

riskManager := risk.NewManager(cfg.Risk)

portfolioManager := portfolio.NewManager(exchangeClients, riskManager)

return &Container{

config: cfg,

logger: logger,

exchangeClients: exchangeClients,

strategyFactory: strategy.NewFactory(),

portfolioManager: portfolioManager,

riskManager: riskManager,

metricsCollector: metrics.NewCollector(),

}, nil

}

DCA Strategy Implementation

The DCA implementation follows the state machine pattern with clear state transitions: INACTIVE → ACTIVE → PROFIT_TAKING → COMPLETED.

package strategy

import (

"context"

"fmt"

"sync"

"time"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/pkg/utils"

)

type DCAStrategy struct {

config types.DCAConfig

state DCAState

currentOrders []types.Order

averagePrice float64

totalInvested float64

totalQuantity float64

safetyOrderCount int

// Dependencies

exchange exchange.Client

portfolioManager *portfolio.Manager

riskManager *risk.Manager

logger *logger.Logger

// Synchronization

mutex sync.RWMutex

// Channels for coordination

signalChan chan types.Signal

stopChan chan struct{}

}

type DCAState int

const (

DCAStateInactive DCAState = iota

DCAStateActive

DCAStateProfitTaking

DCAStateCompleted

)

func NewDCAStrategy(config types.DCAConfig, deps StrategyDependencies) *DCAStrategy {

return &DCAStrategy{

config: config,

state: DCAStateInactive,

exchange: deps.Exchange,

portfolioManager: deps.PortfolioManager,

riskManager: deps.RiskManager,

logger: deps.Logger,

signalChan: make(chan types.Signal, 100),

stopChan: make(chan struct{}),

}

}

func (d *DCAStrategy) Execute(ctx context.Context, market types.MarketData) error {

d.mutex.Lock()

defer d.mutex.Unlock()

if err := d.validateMarketConditions(market); err != nil {

return fmt.Errorf("market validation failed: %w", err)

}

switch d.state {

case DCAStateInactive:

return d.initiateBaseOrder(ctx, market)

case DCAStateActive:

return d.processActiveState(ctx, market)

case DCAStateProfitTaking:

return d.processProfitTaking(ctx, market)

default:

return nil

}

}

func (d *DCAStrategy) initiateBaseOrder(ctx context.Context, market types.MarketData) error {

if !d.riskManager.CanTrade(d.config.BaseOrderSize, d.config.Symbol) {

return ErrRiskLimitsExceeded

}

orderSize := d.calculateOptimalOrderSize(market)

order := types.Order{

ID: utils.GenerateOrderID(),

Symbol: d.config.Symbol,

Side: types.BUY,

Type: types.MARKET,

Quantity: orderSize / market.Price,

Price: market.Price,

Status: types.OrderStatusPending,

Timestamp: time.Now(),

StrategyID: d.config.ID,

}

if err := d.exchange.PlaceOrder(ctx, order); err != nil {

return fmt.Errorf("failed to place base order: %w", err)

}

d.updatePosition(order)

d.state = DCAStateActive

d.logger.Info("DCA base order placed",

"symbol", d.config.Symbol,

"quantity", order.Quantity,

"price", order.Price)

return nil

}

func (d *DCAStrategy) processActiveState(ctx context.Context, market types.MarketData) error {

// Check for safety order conditions

if d.shouldPlaceSafetyOrder(market.Price) {

return d.placeSafetyOrder(ctx, market)

}

// Check for profit taking conditions

if d.shouldTakeProfit(market.Price) {

return d.initiateProfitTaking(ctx, market)

}

return nil

}

func (d *DCAStrategy) shouldPlaceSafetyOrder(currentPrice float64) bool {

if d.safetyOrderCount >= d.config.SafetyOrdersCount {

return false

}

priceDeviationThreshold := d.averagePrice * (1 - d.config.PriceDeviation/100)

return currentPrice <= priceDeviationThreshold

}

func (d *DCAStrategy) placeSafetyOrder(ctx context.Context, market types.MarketData) error {

// Progressive safety order sizing

orderSize := d.config.SafetyOrderSize * d.calculateSafetyOrderMultiplier()

if !d.riskManager.CanTrade(orderSize, d.config.Symbol) {

d.logger.Warn("Safety order blocked by risk manager",

"symbol", d.config.Symbol,

"orderSize", orderSize)

return nil

}

order := types.Order{

ID: utils.GenerateOrderID(),

Symbol: d.config.Symbol,

Side: types.BUY,

Type: types.MARKET,

Quantity: orderSize / market.Price,

Price: market.Price,

Status: types.OrderStatusPending,

Timestamp: time.Now(),

StrategyID: d.config.ID,

OrderTag: fmt.Sprintf("safety_%d", d.safetyOrderCount+1),

}

if err := d.exchange.PlaceOrder(ctx, order); err != nil {

return fmt.Errorf("failed to place safety order: %w", err)

}

d.updatePosition(order)

d.safetyOrderCount++

d.logger.Info("DCA safety order placed",

"symbol", d.config.Symbol,

"safetyOrderNumber", d.safetyOrderCount,

"newAveragePrice", d.averagePrice)

return nil

}

func (d *DCAStrategy) updatePosition(order types.Order) {

newInvestment := order.Quantity * order.Price

newQuantity := order.Quantity

// Calculate new weighted average price

d.averagePrice = (d.totalInvested + newInvestment) / (d.totalQuantity + newQuantity)

d.totalInvested += newInvestment

d.totalQuantity += newQuantity

d.currentOrders = append(d.currentOrders, order)

}

Grid Strategy Implementation

The Grid strategy implementation uses sophisticated state management with dynamic level recalculations and adaptive spacing.

package strategy

import (

"context"

"math"

"sort"

"sync"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/pkg/indicators"

)

type GridStrategy struct {

config types.GridConfig

gridLevels []float64

activeOrders map[float64]types.Order

completedPairs map[string]GridTradePair

totalProfit float64

tradeCount int

// Advanced features

atrIndicator *indicators.ATRIndicator

volatilityAdapter *VolatilityAdapter

profitTracker *ProfitTracker

// Dependencies

exchange exchange.Client

portfolioManager *portfolio.Manager

riskManager *risk.Manager

logger *logger.Logger

// Synchronization

mutex sync.RWMutex

// Performance optimization

priceCache map[float64]time.Time

lastUpdateTime time.Time

updateThreshold time.Duration

}

type GridTradePair struct {

BuyOrder types.Order

SellOrder types.Order

Profit float64

Timestamp time.Time

}

type VolatilityAdapter struct {

atrPeriod int

adaptiveFactor float64

minSpacing float64

maxSpacing float64

}

func NewGridStrategy(config types.GridConfig, deps StrategyDependencies) *GridStrategy {

grid := &GridStrategy{

config: config,

activeOrders: make(map[float64]types.Order),

completedPairs: make(map[string]GridTradePair),

exchange: deps.Exchange,

portfolioManager: deps.PortfolioManager,

riskManager: deps.RiskManager,

logger: deps.Logger,

priceCache: make(map[float64]time.Time),

updateThreshold: time.Second * 5,

}

grid.atrIndicator = indicators.NewATR(14)

grid.volatilityAdapter = &VolatilityAdapter{

atrPeriod: 14,

adaptiveFactor: 0.15,

minSpacing: config.MinGridSpacing,

maxSpacing: config.MaxGridSpacing,

}

grid.calculateGridLevels()

return grid

}

func (g *GridStrategy) Execute(ctx context.Context, market types.MarketData) error {

g.mutex.Lock()

defer g.mutex.Unlock()

// Throttle updates to prevent excessive API calls

if time.Since(g.lastUpdateTime) < g.updateThreshold {

return nil

}

g.lastUpdateTime = time.Now()

if err := g.validatePriceRange(market.Price); err != nil {

return g.handlePriceOutOfRange(ctx, market)

}

// Update volatility-based spacing if enabled

if g.config.AdaptiveSpacing {

g.updateAdaptiveSpacing(market)

}

return g.processGridLevels(ctx, market)

}

func (g *GridStrategy) calculateGridLevels() {

g.gridLevels = make([]float64, g.config.GridLevels)

switch g.config.GridType {

case types.GridTypeArithmetic:

spacing := (g.config.UpperBound - g.config.LowerBound) / float64(g.config.GridLevels-1)

for i := 0; i < g.config.GridLevels; i++ {

g.gridLevels[i] = g.config.LowerBound + float64(i)*spacing

}

case types.GridTypeGeometric:

ratio := math.Pow(g.config.UpperBound/g.config.LowerBound, 1.0/float64(g.config.GridLevels-1))

for i := 0; i < g.config.GridLevels; i++ {

g.gridLevels[i] = g.config.LowerBound * math.Pow(ratio, float64(i))

}

case types.GridTypeAdaptive:

g.calculateAdaptiveGrid()

}

sort.Float64s(g.gridLevels)

}

func (g *GridStrategy) processGridLevels(ctx context.Context, market types.MarketData) error {

currentPrice := market.Price

for _, level := range g.gridLevels {

// Process buy opportunities

if g.shouldPlaceBuyOrder(level, currentPrice) {

if err := g.placeBuyOrder(ctx, level, market); err != nil {

g.logger.Error("Failed to place buy order",

"level", level,

"error", err)

continue

}

}

// Process sell opportunities

if g.shouldPlaceSellOrder(level, currentPrice) {

if err := g.placeSellOrder(ctx, level, market); err != nil {

g.logger.Error("Failed to place sell order",

"level", level,

"error", err)

continue

}

}

}

return g.processFilledOrders(ctx)

}

func (g *GridStrategy) shouldPlaceBuyOrder(level, currentPrice float64) bool {

// Check if price is at or below level and no active buy order exists

if currentPrice > level+g.getToleranceRange(level) {

return false

}

if _, exists := g.activeOrders[level]; exists {

return false

}

return true

}

func (g *GridStrategy) placeBuyOrder(ctx context.Context, level float64, market types.MarketData) error {

orderSize := g.calculateOrderSize(level)

if !g.riskManager.CanTrade(orderSize, g.config.Symbol) {

return ErrRiskLimitsExceeded

}

order := types.Order{

ID: utils.GenerateOrderID(),

Symbol: g.config.Symbol,

Side: types.BUY,

Type: types.LIMIT,

Quantity: orderSize / level,

Price: level,

Status: types.OrderStatusPending,

Timestamp: time.Now(),

StrategyID: g.config.ID,

GridLevel: level,

}

if err := g.exchange.PlaceOrder(ctx, order); err != nil {

return fmt.Errorf("failed to place buy order at level %.2f: %w", level, err)

}

g.activeOrders[level] = order

g.logger.Info("Grid buy order placed",

"symbol", g.config.Symbol,

"level", level,

"quantity", order.Quantity)

return nil

}

func (g *GridStrategy) processFilledOrders(ctx context.Context) error {

filledOrders, err := g.exchange.GetFilledOrders(ctx, g.config.Symbol)

if err != nil {

return fmt.Errorf("failed to get filled orders: %w", err)

}

for _, order := range filledOrders {

if err := g.handleFilledOrder(ctx, order); err != nil {

g.logger.Error("Failed to handle filled order",

"orderID", order.ID,

"error", err)

}

}

return nil

}

func (g *GridStrategy) handleFilledOrder(ctx context.Context, order types.Order) error {

level := order.GridLevel

if order.Side == types.BUY {

// Place corresponding sell order

sellPrice := level * (1 + g.config.TakeProfitPercent/100)

return g.placeSellOrderAtLevel(ctx, sellPrice, order)

} else {

// Complete the trade pair and calculate profit

return g.completeGridTradePair(order)

}

}

func (g *GridStrategy) updateAdaptiveSpacing(market types.MarketData) {

atrValue := g.atrIndicator.Calculate(market.Candles)

if atrValue == 0 {

return

}

optimalSpacing := atrValue * g.volatilityAdapter.adaptiveFactor

// Constrain spacing within bounds

optimalSpacing = math.Max(optimalSpacing, g.volatilityAdapter.minSpacing)

optimalSpacing = math.Min(optimalSpacing, g.volatilityAdapter.maxSpacing)

// Recalculate grid levels with new spacing

newLevels := int((g.config.UpperBound - g.config.LowerBound) / optimalSpacing)

if newLevels != g.config.GridLevels {

g.config.GridLevels = newLevels

g.calculateGridLevels()

g.logger.Info("Grid levels updated based on volatility",

"atrValue", atrValue,

"newSpacing", optimalSpacing,

"newLevels", newLevels)

}

}

Exchange API Integration

The unified exchange interface ensures seamless integration with multiple exchanges using the adapter pattern:

package exchange

import (

"context"

"crypto-trading-strategies/pkg/types"

)

type Client interface {

// Order management

PlaceOrder(ctx context.Context, order types.Order) error

CancelOrder(ctx context.Context, orderID string) error

GetOrder(ctx context.Context, orderID string) (*types.Order, error)

GetActiveOrders(ctx context.Context, symbol string) ([]types.Order, error)

GetFilledOrders(ctx context.Context, symbol string) ([]types.Order, error)

// Market data

GetTicker(ctx context.Context, symbol string) (*types.Ticker, error)

GetOrderBook(ctx context.Context, symbol string, limit int) (*types.OrderBook, error)

GetCandles(ctx context.Context, symbol string, interval string, limit int) ([]types.Candle, error)

// Account information

GetBalance(ctx context.Context) (*types.Balance, error)

GetTradingFees(ctx context.Context, symbol string) (*types.TradingFees, error)

// WebSocket streams

SubscribeToTickers(ctx context.Context, symbols []string) (<-chan types.Ticker, error)

SubscribeToOrderUpdates(ctx context.Context) (<-chan types.OrderUpdate, error)

// Connection management

Ping(ctx context.Context) error

Close() error

}

type ExchangeConfig struct {

Name string

APIKey string

SecretKey string

Passphrase string

Sandbox bool

RateLimit RateLimitConfig

Retry RetryConfig

}

type UnifiedClient struct {

clients map[string]Client

router *RequestRouter

monitor *HealthMonitor

logger *logger.Logger

}

func NewUnifiedClient(configs []ExchangeConfig) (*UnifiedClient, error) {

clients := make(map[string]Client)

for _, config := range configs {

client, err := createExchangeClient(config)

if err != nil {

return nil, fmt.Errorf("failed to create %s client: %w", config.Name, err)

}

clients[config.Name] = client

}

return &UnifiedClient{

clients: clients,

router: NewRequestRouter(),

monitor: NewHealthMonitor(),

}, nil

}

func createExchangeClient(config ExchangeConfig) (Client, error) {

switch strings.ToLower(config.Name) {

case "binance":

return binance.NewClient(config)

case "kraken":

return kraken.NewClient(config)

case "coinbase":

return coinbase.NewClient(config)

default:

return nil, fmt.Errorf("unsupported exchange: %s", config.Name)

}

}

Binance client implementation includes comprehensive error handling and rate limiting:

package binance

import (

"context"

"encoding/json"

"fmt"

"net/http"

"time"

"crypto-trading-strategies/pkg/types"

"golang.org/x/time/rate"

)

type Client struct {

config ExchangeConfig

httpClient *http.Client

rateLimiter *rate.Limiter

baseURL string

// WebSocket connections

wsConn *websocket.Conn

wsReconnect chan struct{}

// Internal state

serverTimeOffset time.Duration

lastWeightUpdate time.Time

currentWeight int

logger *logger.Logger

}

func NewClient(config ExchangeConfig) (*Client, error) {

client := &Client{

config: config,

httpClient: createHTTPClient(),

rateLimiter: rate.NewLimiter(rate.Limit(config.RateLimit.RequestsPerSecond), config.RateLimit.Burst),

baseURL: getBinanceURL(config.Sandbox),

wsReconnect: make(chan struct{}, 1),

logger: logger.NewLogger("binance"),

}

if err := client.syncServerTime(); err != nil {

return nil, fmt.Errorf("failed to sync server time: %w", err)

}

return client, nil

}

func (c *Client) PlaceOrder(ctx context.Context, order types.Order) error {

if err := c.rateLimiter.Wait(ctx); err != nil {

return fmt.Errorf("rate limit exceeded: %w", err)

}

params := c.buildOrderParams(order)

var response BinanceOrderResponse

if err := c.makeSignedRequest(ctx, "POST", "/api/v3/order", params, &response); err != nil {

return c.handleOrderError(err, order)

}

// Update order with exchange response

order.ID = response.OrderID

order.Status = mapBinanceOrderStatus(response.Status)

order.Timestamp = time.Unix(response.TransactTime/1000, 0)

c.logger.Info("Order placed successfully",

"symbol", order.Symbol,

"side", order.Side,

"quantity", order.Quantity,

"orderID", order.ID)

return nil

}

func (c *Client) makeSignedRequest(ctx context.Context, method, endpoint string, params map[string]interface{}, result interface{}) error {

params["timestamp"] = time.Now().Add(c.serverTimeOffset).UnixNano() / 1e6

signature := c.generateSignature(params)

params["signature"] = signature

url := c.baseURL + endpoint

req, err := c.buildHTTPRequest(method, url, params)

if err != nil {

return fmt.Errorf("failed to build request: %w", err)

}

req.Header.Set("X-MBX-APIKEY", c.config.APIKey)

req = req.WithContext(ctx)

resp, err := c.httpClient.Do(req)

if err != nil {

return fmt.Errorf("request failed: %w", err)

}

defer resp.Body.Close()

if err := c.handleHTTPResponse(resp, result); err != nil {

return err

}

// Update rate limit tracking

c.updateRateLimitInfo(resp.Header)

return nil

}

func (c *Client) SubscribeToTickers(ctx context.Context, symbols []string) (<-chan types.Ticker, error) {

tickerChan := make(chan types.Ticker, 1000)

wsURL := c.buildWebSocketURL(symbols)

conn, err := websocket.Dial(wsURL, "", c.baseURL)

if err != nil {

return nil, fmt.Errorf("failed to connect to WebSocket: %w", err)

}

c.wsConn = conn

go c.handleWebSocketMessages(ctx, tickerChan)

go c.maintainWebSocketConnection(ctx)

return tickerChan, nil

}

func (c *Client) handleWebSocketMessages(ctx context.Context, tickerChan chan<- types.Ticker) {

defer close(tickerChan)

for {

select {

case <-ctx.Done():

return

case <-c.wsReconnect:

if err := c.reconnectWebSocket(); err != nil {

c.logger.Error("Failed to reconnect WebSocket", "error", err)

continue

}

default:

var message BinanceTickerMessage

if err := websocket.JSON.Receive(c.wsConn, &message); err != nil {

c.logger.Error("WebSocket receive error", "error", err)

c.wsReconnect <- struct{}{}

continue

}

ticker := c.convertBinanceTicker(message)

select {

case tickerChan <- ticker:

case <-ctx.Done():

return

}

}

}

}

A professional implementation includes a comprehensive testing framework with mocked external dependencies and integration tests for validating real market conditions. The architecture supports horizontal scaling through microservices and cloud-native deployment patterns with Kubernetes orchestration. This technical implementation demonstrates enterprise-grade code quality with proper separation of concerns, comprehensive error handling, and production-ready features such as graceful shutdown, rate limiting, and observability via structured logging and metrics collection.

Practical recommendations

After reviewing the technical aspects of implementation, it is critically important to provide actionable recommendations for the selection and application of trading strategies. The modern trading bot market offers a wide range of options - from simple DCA solutions to complex AI-driven systems - and the right choice can determine the success or failure of trading activity.

Choosing a Strategy by Trader Profile

The DCA strategy is ideally suited for beginner traders thanks to its simplicity and psychological resilience. For newcomers, it is especially important to start with conservative limits and risk only small amounts until confidence in the strategy develops. The profile of an ideal DCA trader includes:

First experience in crypto trading: no need for deep technical analysis knowledge

Preference for long-term investments: planning horizon of 6 months to several years

Limited time to monitor the market: ability to check positions only 1–2 times per week

Low risk tolerance: comfortable with a maximum drawdown of 10–15%

strategy:

type: "dca"

symbol: "BTCUSDT"

base_order_size: 50.0 # Minimum initial size

safety_order_size: 50.0 # Conservative averaging

safety_orders_count: 3 # Limited number of orders

price_deviation: 5.0 # Wide intervals for safety

take_profit: 3.0 # Conservative take profit

risk_management:

max_drawdown: 15.0 # Strict drawdown limit

daily_loss_limit: 5.0 # Daily loss limit

Grid Trading requires a much higher level of involvement and understanding of market dynamics. Some low-risk crypto trading bots boast a 99% success rate, while others employ higher-risk strategies with lower success percentages. The optimal Grid trader profile includes:

Understanding of technical analysis: knowledge of key indicators and patterns

Willingness for active management: daily monitoring and parameter adjustments

Sufficient capital for diversification: at least $5,000 for effective risk distribution

High tolerance to volatility: comfort with frequent P&L fluctuations

package strategy

type AdvancedGridConfig struct {

Symbol string `json:"symbol"`

UpperBound float64 `json:"upper_bound"`

LowerBound float64 `json:"lower_bound"`

GridLevels int `json:"grid_levels"`

OrderSize float64 `json:"order_size"`

// Advanced options for experienced traders

VolatilityFactor float64 `json:"volatility_factor"`

AdaptiveSpacing bool `json:"adaptive_spacing"`

RebalanceInterval string `json:"rebalance_interval"`

RiskParameters struct {

MaxDrawdown float64 `json:"max_drawdown"`

StopLossPercent float64 `json:"stop_loss_percent"`

TakeProfitRatio float64 `json:"take_profit_ratio"`

} `json:"risk_parameters"`

}

func NewAdvancedGridStrategy(config AdvancedGridConfig) *GridStrategy {

return &GridStrategy{

config: config,

volatilityEngine: NewVolatilityEngine(config.VolatilityFactor),

riskManager: NewAdvancedRiskManager(config.RiskParameters),

adaptiveLogic: config.AdaptiveSpacing,

}

}

Hybrid Approach: Combo Bots

The revolutionary concept of combo bots represents a unique hybrid of Dollar-Cost Averaging (DCA) and Grid Trading. They operate primarily as DCA bots but, instead of executing a full exit all at once, they use a structure called Minigrids. This innovative architecture addresses the key shortcomings of both strategies. Advantages: Risk reduction while preserving profitability. Combo bots combine the passive income generation of Grid bots with the risk-mitigation benefits of DCA, eliminating the timing risk of lump-sum investments while still maintaining consistent profit extraction. Key benefits include:

Elimination of timing risk: no need for precise entry timing

Continuous profit generation: consistent harvesting of volatility

Capital efficiency: intelligent allocation with gradual position building

Adaptive range management: automatic expansion of the trading range

package strategy

import (

"context"

"crypto-trading-strategies/pkg/types"

)

type ComboStrategy struct {

dcaEngine *DCAEngine

gridEngine *GridEngine

minigrids map[float64]*Minigrid

currentMode ComboMode

// Hybrid Strategy Parameters

config ComboConfig

stateManager *ComboStateManager

// Dependencies

exchange exchange.Client

portfolioManager *portfolio.Manager

riskManager *risk.Manager

logger *logger.Logger

}

type ComboMode int

const (

ComboModeDCA ComboMode = iota

ComboModeGrid

ComboModeHybrid

)

type Minigrid struct {

ID string `json:"id"`

Range types.PriceRange `json:"range"`

Orders []types.Order `json:"orders"`

Status MinigridStatus `json:"status"`

CreatedAt time.Time `json:"created_at"`

ProfitTarget float64 `json:"profit_target"`

}

func (c *ComboStrategy) Execute(ctx context.Context, market types.MarketData) error {

c.mutex.Lock()

defer c.mutex.Unlock()

// Analysis of market conditions to determine the optimal regime

optimalMode := c.determineOptimalMode(market)

if c.shouldSwitchMode(optimalMode) {

if err := c.switchMode(ctx, optimalMode); err != nil {

return fmt.Errorf("failed to switch mode: %w", err)

}

}

return c.executeCurrentMode(ctx, market)

}

func (c *ComboStrategy) determineOptimalMode(market types.MarketData) ComboMode {

volatility := c.calculateVolatility(market.Candles)

trend := c.analyzeTrend(market)

// The logic of choosing a mode based on market conditions

switch {

case volatility > c.config.HighVolatilityThreshold && trend == types.TrendSideways:

return ComboModeGrid

case trend == types.TrendBearish:

return ComboModeDCA

default:

return ComboModeHybrid

}

}

func (c *ComboStrategy) createMinigrid(dcaLevel float64, market types.MarketData) (*Minigrid, error) {

gridRange := types.PriceRange{

Lower: dcaLevel * (1 - c.config.MinigridSpread/100),

Upper: dcaLevel * (1 + c.config.MinigridSpread/100),

}

minigrid := &Minigrid{

ID: utils.GenerateMinigridID(),

Range: gridRange,

Status: MinigridStatusActive,

CreatedAt: time.Now(),

ProfitTarget: c.config.MinigridProfitTarget,

}

// Creating grid orders inside a minigrid

orders, err := c.generateMinigridOrders(minigrid, market)

if err != nil {

return nil, fmt.Errorf("failed to generate minigrid orders: %w", err)

}

minigrid.Orders = orders

c.minigrids[dcaLevel] = minigrid

c.logger.Info("Minigrid created",

"id", minigrid.ID,

"range", gridRange,

"orders", len(orders))

return minigrid, nil

}

Risk Management

A modern approach to risk management requires sophisticated portfolio allocation across multiple strategies. Success depends on proper strategy selection, rigorous testing, professional infrastructure, and continuous optimization:

package portfolio

type StrategyAllocation struct {

Strategy string `json:"strategy"`

Allocation float64 `json:"allocation"` // Percentage of total capital

MaxDrawdown float64 `json:"max_drawdown"` // Maximum drawdown

Performance PerformanceMetrics `json:"performance"`

}

type DiversificationManager struct {

allocations map[string]*StrategyAllocation

rebalancer *RebalanceEngine

monitor *PerformanceMonitor

// Diversification parameters

config struct {

MaxStrategyAllocation float64 `json:"max_strategy_allocation"` // 40%

MinCorrelation float64 `json:"min_correlation"` // 0.3

RebalanceThreshold float64 `json:"rebalance_threshold"` // 5%

}

}

func (dm *DiversificationManager) OptimizeAllocation(

strategies []Strategy,

targetReturn float64,

maxRisk float64,

) (*AllocationPlan, error) {

// Analysis of the correlation between strategies

correlationMatrix := dm.calculateCorrelations(strategies)

// Markowitz Optimization for crypto portfolio

optimizer := NewModernPortfolioOptimizer()

allocation, err := optimizer.Optimize(OptimizationParams{

Strategies: strategies,

TargetReturn: targetReturn,

MaxRisk: maxRisk,

Correlations: correlationMatrix,

Constraints: dm.config,

})

if err != nil {

return nil, fmt.Errorf("optimization failed: %w", err)

}

return allocation, nil

}

The optimal stop-loss configuration varies depending on the trading strategy and the asset's volatility. For trend-following strategies, a stop-loss of 2–4% may provide enough breathing room without premature exits:

package risk

type StopLossEngine struct {

strategies map[string]*StopLossConfig

atr *indicators.ATRIndicator

volatilityCalculator *VolatilityCalculator

}

type StopLossConfig struct {

Type StopLossType `json:"type"`

StaticPercent float64 `json:"static_percent"`

ATRMultiplier float64 `json:"atr_multiplier"`

TrailingDistance float64 `json:"trailing_distance"`

VolatilityBased bool `json:"volatility_based"`

}

type StopLossType string

const (

StopLossTypeStatic StopLossType = "static"

StopLossTypeTrailing StopLossType = "trailing"

StopLossTypeVolatility StopLossType = "volatility"

StopLossTypeAdaptive StopLossType = "adaptive"

)

func (sle *StopLossEngine) CalculateStopLoss(

strategy string,

entryPrice float64,

market types.MarketData,

) (float64, error) {

config, exists := sle.strategies[strategy]

if !exists {

return 0, fmt.Errorf("stop loss config not found for strategy: %s", strategy)

}

switch config.Type {

case StopLossTypeStatic:

return entryPrice * (1 - config.StaticPercent/100), nil

case StopLossTypeVolatility:

atrValue := sle.atr.Calculate(market.Candles)

return entryPrice - (atrValue * config.ATRMultiplier), nil

case StopLossTypeAdaptive:

return sle.calculateAdaptiveStopLoss(entryPrice, market, config)

default:

return entryPrice * (1 - 0.02), nil // Default 2% stop-loss

}

}

Comprehensive performance monitoring enables continuous optimization of trading strategies:

package analytics

type PerformanceTracker struct {

strategies map[string]*StrategyMetrics

collector *metrics.Collector

alerter *AlertManager

// Key performance metrics

kpiTargets map[string]float64

}

type StrategyMetrics struct {

TotalReturn float64 `json:"total_return"`

AnnualizedReturn float64 `json:"annualized_return"`

SharpeRatio float64 `json:"sharpe_ratio"`

MaxDrawdown float64 `json:"max_drawdown"`

WinRate float64 `json:"win_rate"`

ProfitFactor float64 `json:"profit_factor"`

// Risk metrics

VaR95 float64 `json:"var_95"`

CVaR95 float64 `json:"cvar_95"`

Volatility float64 `json:"volatility"`

// Operational metrics

TradeCount int `json:"trade_count"`

AvgTradeSize float64 `json:"avg_trade_size"`

TradingFrequency float64 `json:"trading_frequency"`

}

func (pt *PerformanceTracker) GeneratePerformanceReport(

strategy string,

period time.Duration,

) (*PerformanceReport, error) {

metrics := pt.strategies[strategy]

if metrics == nil {

return nil, fmt.Errorf("no metrics found for strategy: %s", strategy)

}

report := &PerformanceReport{

Strategy: strategy,

Period: period,

Metrics: metrics,

Analysis: pt.generateAnalysis(metrics),

Recommendations: pt.generateRecommendations(metrics),

RiskAssessment: pt.assessRisk(metrics),

}

// Checking for compliance with KPI targets

if metrics.SharpeRatio < pt.kpiTargets["min_sharpe"] {

report.Alerts = append(report.Alerts, Alert{

Type: "performance",

Message: "Sharpe ratio below target",

Severity: "medium",

})

}

return report, nil

}

Effective application of practical recommendations requires constant monitoring of market conditions, adapting strategies to changing environments, and strict adherence to risk management principles. The best bot trading strategies combine mathematical rigor with adaptive AI, emphasizing consistent risk management over spectacular returns. Modern algorithmic systems provide the speed, discipline, and market coverage that define success in contemporary trading.

The Future of Automated Trading

Automated trading stands on the threshold of revolutionary changes that will radically transform the cryptocurrency landscape in the coming years. The democratization of sophisticated trading algorithms, once accessible only to hedge funds and institutional investors, is now making them available to retail traders, creating unprecedented opportunities for individual market participants.

AI Integration: Machine Learning in Trading Algorithms

Machine learning no longer relies on rigid rules but dynamically adapts to market changes, learning from both historical trends and real-time inputs. Modern AI systems demonstrate superior pattern recognition, processing massive volumes of historical and real-time data to uncover non-obvious correlations.

package ai

import (

"context"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/internal/indicators"

)

type MLEngine struct {

reinfLearning *ReinforcementLearning

walkForward *WalkForwardOptimizer

regimeDetector *RegimeDetector

adversarialTester *AdversarialTester

}

type ReinforcementLearning struct {

rewards map[string]float64

penalties map[string]float64

strategy Strategy

}

// AdaptToMarketConditions uses reinforcement learning to

// continuously improve its strategy

func (ml *MLEngine) AdaptToMarketConditions(

ctx context.Context,

market types.MarketData,

) (*OptimizedStrategy, error) {

// Determining the current market regime

regime := ml.regimeDetector.ClassifyMarket(market)

// Walk-forward parameter optimization

optimizedParams, err := ml.walkForward.OptimizeParams(

market.Candles,

regime,

)

if err != nil {

return nil, fmt.Errorf("walk-forward optimization failed: %w", err)

}

// Dynamic resizing of positions

dynamicSizing := ml.calculateDynamicPositionSizing(market, regime)

return &OptimizedStrategy{

Parameters: optimizedParams,

PositionSize: dynamicSizing,

Regime: regime,

Confidence: ml.calculateConfidence(market),

}, nil

}

type RegimeDetector struct {

indicators []*indicators.TechnicalIndicator

mlModel *MachineLearningModel

}

// ClassifyMarket automatically classifies market conditions

func (rd *RegimeDetector) ClassifyMarket(market types.MarketData) RegimeType {

features := rd.extractFeatures(market)

return rd.mlModel.Predict(features)

}

type RegimeType int

const (

TrendingUp RegimeType = iota

TrendingDown

RangeBound

HighVolatility

LowVolatility

)

Reinforcement learning creates a feedback loop that continuously improves the strategy through walk-forward optimization, regime detection, and adversarial testing. These machine learning capabilities bring practical advantages in volatile markets.

Sentiment Analysis and Alternative Data

AI trading bots are increasingly leveraging alternative data to gain a broader perspective on market sentiment, including social media, news articles, economic indicators, and even satellite imagery. Natural Language Processing enables bots to interpret market sentiment and make better-informed trading decisions.

package ai

import (

"context"

"time"

"crypto-trading-strategies/pkg/nlp"

)

type SentimentAnalyzer struct {

nlpProcessor *nlp.Processor

dataSources map[string]DataSource

aggregator *SentimentAggregator

}

type SentimentData struct {

Source string `json:"source"`

Symbol string `json:"symbol"`

Sentiment float64 `json:"sentiment"` // -1.0 to 1.0

Confidence float64 `json:"confidence"`

Timestamp time.Time `json:"timestamp"`

Volume int `json:"mention_volume"`

}

// AnalyzeMarketSentiment processes multiple data sources

func (sa *SentimentAnalyzer) AnalyzeMarketSentiment(

ctx context.Context,

symbol string,

timeframe time.Duration,

) (*AggregatedSentiment, error) {

var sentiments []SentimentData

// Parallel processing of multiple sources

for sourceName, source := range sa.dataSources {

go func(name string, src DataSource) {

data, err := src.FetchData(ctx, symbol, timeframe)

if err != nil {

return

}

processed := sa.nlpProcessor.ProcessText(data)

sentiment := SentimentData{

Source: name,

Symbol: symbol,

Sentiment: processed.Score,

Confidence: processed.Confidence,

Timestamp: time.Now(),

Volume: processed.MentionCount,

}

sentiments = append(sentiments, sentiment)

}(sourceName, source)

}

return sa.aggregator.Aggregate(sentiments), nil

}

type DataSource interface {

FetchData(ctx context.Context, symbol string, timeframe time.Duration) ([]string, error)

}

// TwitterSource implements Twitter/X data analysis

type TwitterSource struct {

apiClient *TwitterAPI

}

// NewsSource handles financial news

type NewsSource struct {

feeds []NewsFeed

}

// RedditSource analyzes discussions on Reddit

type RedditSource struct {

subreddits []string

}

Advanced Risk Management

Modern risk management systems integrate AI for more precise forecasting and prevention of catastrophic losses:

package risk

import (

"context"

"crypto-trading-strategies/pkg/types"

"crypto-trading-strategies/internal/ai"

)

type AIRiskManager struct {

varCalculator *VaRCalculator

stressTestEngine *StressTestEngine

portfolioOptimizer *PortfolioOptimizer

anomalyDetector *AnomalyDetector

}

type VaRCalculator struct {

model string // "historical", "parametric", "monte_carlo"

confidenceLevel float64 // 0.95, 0.99

holdingPeriod int // days

}

// CalculateRisk uses Monte Carlo simulations for VaR

func (rm *AIRiskManager) CalculateRisk(

ctx context.Context,

portfolio *types.Portfolio,

market types.MarketData,

) (*RiskMetrics, error) {

// Value at Risk calculate

var95 := rm.varCalculator.CalculateVaR(portfolio, 0.95)

var99 := rm.varCalculator.CalculateVaR(portfolio, 0.99)

// Conditional Value at Risk (Expected Shortfall)

cvar95 := rm.varCalculator.CalculateCVaR(portfolio, 0.95)

// Portfolio Stress testing

stressResults := rm.stressTestEngine.RunStressTests(portfolio, []StressScenario{

{Name: "2022_crypto_crash", MarketShock: -0.80},

{Name: "flash_crash", MarketShock: -0.30, Duration: time.Hour},

{Name: "liquidity_crisis", LiquidityImpact: 0.5},

})

// Detecting anomalies in trading patterns

anomalies := rm.anomalyDetector.DetectAnomalies(portfolio.TradingHistory)

return &RiskMetrics{

VaR95: var95,

VaR99: var99,

CVaR95: cvar95,

StressResults: stressResults,

Anomalies: anomalies,

RiskScore: rm.calculateCompositeRisk(var95, cvar95, stressResults),

}, nil

}

type StressTestEngine struct {

scenarios []StressScenario

monteCarlo *MonteCarloEngine

}

type StressScenario struct {

Name string

MarketShock float64 // percentage price change

Duration time.Duration // duration of shock

LiquidityImpact float64 // impact on liquidity

}

These tools combine Value-at-Risk, Conditional VaR, stress testing, and anomaly detection to create a multi-layered risk protection framework.

Cross-Chain Trading: Arbitrage Across Blockchains

Cross-chain arbitrage has become one of the most promising areas, allowing traders to exploit price discrepancies across different blockchains. The development of Layer 2 solutions and interoperability protocols creates new opportunities for arbitrage.

package crosschain

import (

"context"

"sync"

"crypto-trading-strategies/pkg/types"

)

type CrossChainArbitrageEngine struct {

bridges map[string]Bridge

dexes map[string]DEXClient

flashLoaners map[string]FlashLoanProvider

gasTracker *GasTracker

// Concurrent execution

executor *CrossChainExecutor

mutex sync.RWMutex

}

type Bridge interface {

Transfer(ctx context.Context, token string, amount float64,

fromChain, toChain string) (*TransferReceipt, error)

EstimateTime(fromChain, toChain string) time.Duration

EstimateFee(token string, amount float64, fromChain, toChain string) (float64, error)

}

type ArbitrageOpportunity struct {

TokenSymbol string `json:"token_symbol"`

BuyChain string `json:"buy_chain"`

SellChain string `json:"sell_chain"`

BuyPrice float64 `json:"buy_price"`

SellPrice float64 `json:"sell_price"`

ProfitMargin float64 `json:"profit_margin"`

RequiredCapital float64 `json:"required_capital"`

EstimatedProfit float64 `json:"estimated_profit"`

Risks []string `json:"risks"`

ExecutionTime time.Duration `json:"execution_time"`

GasFees map[string]float64 `json:"gas_fees"`

}

// ScanArbitrageOpportunities is looking for arbitration opportunities between networks

func (ace *CrossChainArbitrageEngine) ScanArbitrageOpportunities(

ctx context.Context,

tokens []string,

) ([]ArbitrageOpportunity, error) {

var opportunities []ArbitrageOpportunity

var wg sync.WaitGroup

opsChan := make(chan ArbitrageOpportunity, 100)

// Parallel scanning of all pairs of chains

for _, token := range tokens {

for buyChain := range ace.dexes {

for sellChain := range ace.dexes {

if buyChain == sellChain {

continue

}

wg.Add(1)

go func(token, buy, sell string) {

defer wg.Done()

opp := ace.analyzeOpportunity(ctx, token, buy, sell)

if opp.ProfitMargin > ace.getMinProfitThreshold() {

opsChan <- opp

}

}(token, buyChain, sellChain)

}

}

}

// Closing the channel after completing all goroutines

go func() {

wg.Wait()

close(opsChan)

}()

// Collecting results

for opp := range opsChan {

opportunities = append(opportunities, opp)

}

return ace.filterAndRankOpportunities(opportunities), nil

}

//ExecuteArbitrage performs cross-chain arbitration using flash loans

func (ace *CrossChainArbitrageEngine) ExecuteArbitrage(

ctx context.Context,

opportunity ArbitrageOpportunity,

) (*ArbitrageResult, error) {

// Getting a flash loan for initial capital

flashLoan, err := ace.flashLoaners[opportunity.BuyChain].RequestLoan(

ctx,

opportunity.TokenSymbol,

opportunity.RequiredCapital,

)

if err != nil {

return nil, fmt.Errorf("flash loan failed: %w", err)

}

// Performing arbitration within a single transaction

result := &ArbitrageResult{

OpportunityID: opportunity.ID,

StartTime: time.Now(),

}

// Purchase of a token on the source network

buyTx, err := ace.dexes[opportunity.BuyChain].BuyToken(

ctx,

opportunity.TokenSymbol,

opportunity.RequiredCapital,

)

if err != nil {

return result, fmt.Errorf("buy failed: %w", err)

}

result.BuyTransaction = buyTx

// Bridge tokens to the target network

bridgeTx, err := ace.bridges[opportunity.BuyChain].Transfer(

ctx,

opportunity.TokenSymbol,

buyTx.TokenAmount,

opportunity.BuyChain,

opportunity.SellChain,

)

if err != nil {

return result, fmt.Errorf("bridge failed: %w", err)

}

result.BridgeTransaction = bridgeTx

// Token sale on the target network

sellTx, err := ace.dexes[opportunity.SellChain].SellToken(

ctx,

opportunity.TokenSymbol,

buyTx.TokenAmount,

)

if err != nil {

return result, fmt.Errorf("sell failed: %w", err)

}

result.SellTransaction = sellTx

// Flash loan refund

repayment := flashLoan.Principal + flashLoan.Fee

if sellTx.ReceivedAmount < repayment {

return result, fmt.Errorf("insufficient funds to repay flash loan")

}

err = ace.flashLoaners[opportunity.BuyChain].RepayLoan(ctx, flashLoan)

if err != nil {

return result, fmt.Errorf("loan repayment failed: %w", err)

}

result.NetProfit = sellTx.ReceivedAmount - repayment

result.EndTime = time.Now()

result.Success = true

return result, nil

}

AI-powered arbitrage bots analyze real-time price differences across DEXs on different blockchains, using machine learning to optimize arbitrage paths. Protocols like LayerZero, Axelar, and Wormhole enable seamless cross-chain communication.

Regulatory Environment

The regulatory landscape underwent dramatic changes in 2025 with the GENIUS Act and the STABLE Act, which placed stablecoin issuers under the Bank Secrecy Act, making KYC, AML, and CFT rules mandatory for all organizations facilitating digital asset transfers.

package compliance

import (

"context"

"time"

"crypto-trading-strategies/pkg/types"

)

type ComplianceEngine struct {

kycProvider KYCProvider

amlMonitor AMLMonitor

sanctionsDB SanctionsDatabase

riskScorer RiskScorer

reportManager ReportManager

}

type KYCProvider interface {

VerifyIdentity(ctx context.Context, customer Customer) (*KYCResult, error)

UpdateVerification(ctx context.Context, customerID string) error

GetVerificationStatus(customerID string) (KYCStatus, error)

}

type AMLMonitor interface {

MonitorTransaction(ctx context.Context, tx Transaction) (*AMLAlert, error)