Second-hand Furniture Market: The Allure of Unique Designs

Georgie Bill

Georgie BillThe global second-hand furniture market was valued at USD 34.01 billion in 2023 and is projected to reach USD 56.66 billion by 2030, growing at a CAGR of 7.7% from 2024 to 2030. This growth is being primarily driven by increasing environmental consciousness and a rising preference for sustainable living, which is leading more consumers to choose pre-owned furniture over new items.

The growing popularity of vintage and unique furniture designs, along with economic considerations, is further boosting demand. Online platforms have significantly contributed to this market expansion by providing easy access to buying and selling second-hand furniture, making the process more convenient for consumers. For example, Made.com, a prominent home décor brand, partnered with Geev, an online marketplace for used furniture, in May 2021. This collaboration allows Made.com customers to donate their pre-loved furniture via the Geev platform, thus promoting circular economy practices and contributing to market growth.

The increasing demand for home furnishings, particularly among millennials and Gen Z, has been another key factor propelling the second-hand furniture market. These younger generations, particularly in the U.S., accounted for nearly 70% of the second-hand furniture purchases in the latter half of 2022, driven by their desire for personalized, stylish, and affordable living spaces. As these groups continue to prioritize aesthetic changes in their homes, the demand for pre-owned furniture is expected to rise significantly.

Order a free sample PDF of the Second-hand Furniture Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

Regional Insights: The Asia Pacific region held 32.45% of the global second-hand furniture market revenue in 2023. The rapid urbanization and evolving consumer lifestyles in countries across this region, particularly in India, have fueled a rise in the demand for second-hand furniture. Factors such as relocation for work or education and changing lifestyle preferences have increased the need for cost-effective and flexible furnishing options, which second-hand furniture readily provides.

Product Insights: In 2023, second-hand bed sales accounted for 24.15% of the market share. This is mainly attributed to growing awareness of sustainable living, with consumers increasingly opting for pre-owned beds to minimize their environmental footprint. In November 2022, Kaiyo, a prominent furniture resale platform, reported that half of its customers cited sustainability as a primary factor driving their decision to sell used furniture online.

Material Insights: Wooden furniture dominated the second-hand furniture market with a 39.33% revenue share in 2023. Wooden furniture is highly regarded for its durability, timeless aesthetic, and the sustainability of reusing such items. The enduring popularity of wooden furniture, along with its availability on resale platforms, has fueled the growth in sales of second-hand wooden pieces.

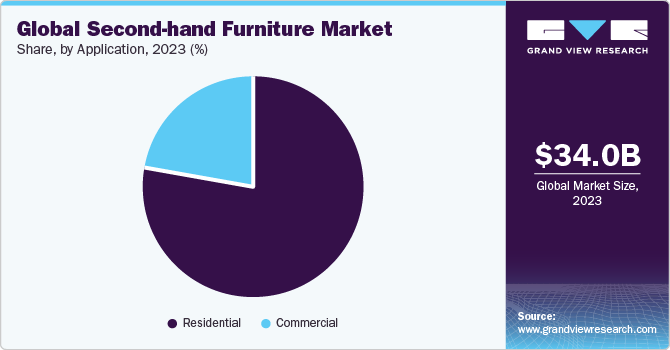

Application Insights: The residential sector led the market with a 78.23% revenue share in 2023. Demand for second-hand furniture in residential settings, particularly for living room and bedroom furnishings, is expected to continue rising, driven by increased real estate construction projects in urban areas. The growing trend of homeownership and rental properties also supports the expansion of second-hand furniture sales.

Market Size & Forecast

2023 Market Size: USD 34.01 billion

2030 Projected Market Size: USD 56.66 billion

CAGR (2024-2030): 7.7%

Asia Pacific: Largest market in 2023

Key Companies & Market Share Insights

The global second-hand furniture market is highly fragmented and largely unorganized, with numerous small players across the industry. However, several key companies are innovating through partnerships and sustainability initiatives to capture a larger market share. Many companies are forming collaborations with resale platforms to provide more convenience for consumers, making it easier to buy and sell second-hand furniture.

Additionally, companies are exploring circular economy models, focusing on refurbishing and recycling furniture to extend its lifecycle. These eco-friendly initiatives are gaining traction, as both businesses and consumers increasingly prioritize sustainability. The focus on sustainable practices not only helps reduce waste but also makes second-hand furniture a more cost-effective and environmentally conscious alternative to new pieces.

Key Players

IKEA

Envirotech Products Company

Beverly Hills Chairs

Steelcase Inc.

Second Hand Office Furniture Co.

Pottery Barn

Rework Office Furniture

Thrift Super Store

Almost Perfect Furniture

OneUp Furniture

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The global second-hand furniture market is set for significant growth, driven by rising environmental awareness, consumer demand for sustainable products, and the increasing appeal of vintage and unique designs. The market is particularly strong among millennials and Gen Z, who prioritize personalization and affordability in their home décor choices. With platforms like Made.com and Geev promoting circular economy initiatives and facilitating the buying and selling of pre-owned furniture, the market is becoming more accessible and convenient for consumers.

As sustainability continues to shape purchasing decisions, the demand for second-hand furniture in both the residential and commercial sectors is expected to rise. The Asia Pacific region is poised to be a major contributor to market growth due to rapid urbanization and changing consumer lifestyles. With key players focusing on innovative partnerships, sustainable practices, and circular economy models, the second-hand furniture market is well-positioned to thrive in the coming years.

Subscribe to my newsletter

Read articles from Georgie Bill directly inside your inbox. Subscribe to the newsletter, and don't miss out.

Written by